Holding steady as Budget powers grow

- Published

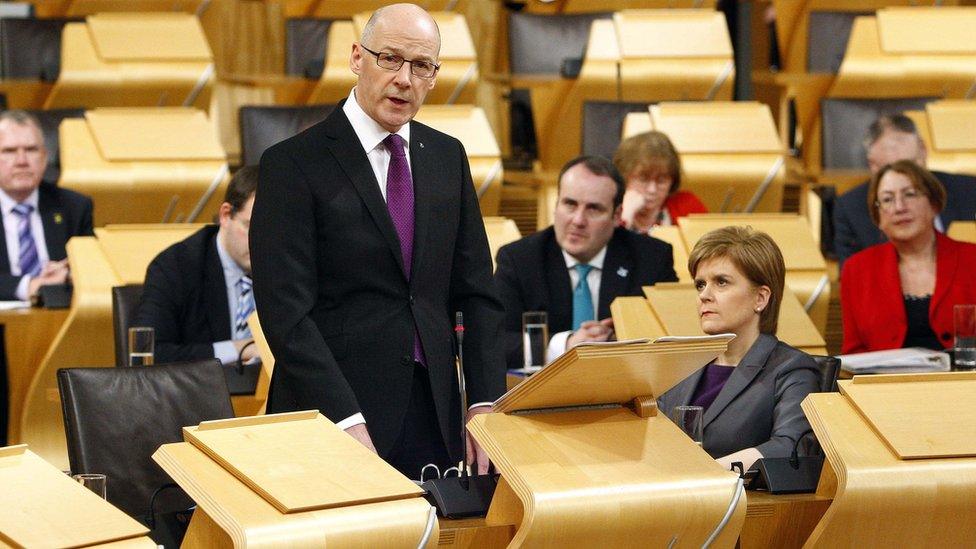

Has John Swinney indicated his future thoughts?

It was, said John Swinney, a budget statement which covered but a single year; 2016/17. The tardiness of the Chancellor's announcements, themselves dictated by the UK election timetable, pre-empted any prospect of a full forward review of Scottish spending plans.

However, there were some future indications. In particular, did we get a glimpse of Mr Swinney's thoughts on transforming local authority taxation?

I think we did. Mr Swinney said he would study the report from the Commission on Local Taxation and, in the New Year, "set out plans to reform the council tax". Reform, note, not replace.

Further, he said he would talk to councils about trying to find ways of assigning a proportion of income tax receipts to local authorities as "an incentive to boost economic growth in their areas".

Conservatives say that Mr Swinney will struggle to complain about cuts when he refuses to increase income tax

That blend, then, could represent the offer by the incumbent government. Reform might involve increasing the number of bands in a way to ensure that the most valuable properties pay a higher levy.

There could be other ideas, of course. And there could be alternative schemes proposed by rival parties. But not, it would seem, a full-blooded Local Income Tax. That notion, I believe, succumbed to previous detailed scrutiny within government.

On tax more generally, Mr Swinney announced a dual freeze. Freezing income tax (under the Calman powers, introduced via the Scotland Act 2012) and continuing the council tax freeze into its ninth year.

In practice, Mr Swinney was holding steady in this budget - for understandable reasons. Firstly, there are big changes pending: reforming council tax, reviewing business rates, extra tax powers from the Smith Commission.

All that plus there is still no final deal on the Fiscal Framework which will accompany the Smith powers - although one is now firmly forecast for February. All that adds up to a climate of arithmetical and political uncertainty.

But secondly there are elections to the Scottish Parliament in May. Mr Swinney does not lack fortitude but it would have taken a particularly courageous Finance Secretary (in the Yes Minister mode) to hike income tax, at the first time of asking under new powers, weeks before those polls.

However, the minister is adamant that he is taking action where he can to help hard-pressed families. Mitigating the impact of welfare cuts, that dual freeze, public service reform to target cash and improve performance where it matters - in delivery.

Labour critics, such as Jackie Baillie, say that it is the Scottish government that is frozen

Labour critics, however, say that it is the Scottish government which is frozen; failing to reverse austerity. Liberal Democrats say that the police reforms have palpably failed to release funds. And Conservatives say that Mr Swinney will struggle to complain about cuts when he refuses to increase income tax.

In response, Mr Swinney says he has taken action on tax. An extra £130m raised from big business in rates, while protecting small firms. Decisions on landfill tax and LBTT; both, he argues, driven by progressive impetus.

And the spending plans. More for the NHS, childcare, schools, police. A cut of £320m in day to day local government spending - but with £250m transferred from the health budget to pay for a reformed social care programme designed to help the elderly, in particular, to get the support they need rather than languishing in hospital.

Steadily, steadily, budget day at Holyrood is becoming more and more big league. Bigger decisions yet to come - on taxation, on expenditure - as Holyrood's powers grow and the election arrives.

- Published16 December 2015

- Published16 December 2015

- Published16 December 2015