Paradise Papers: Blackstone avoided UK taxes on St Enoch Centre

- Published

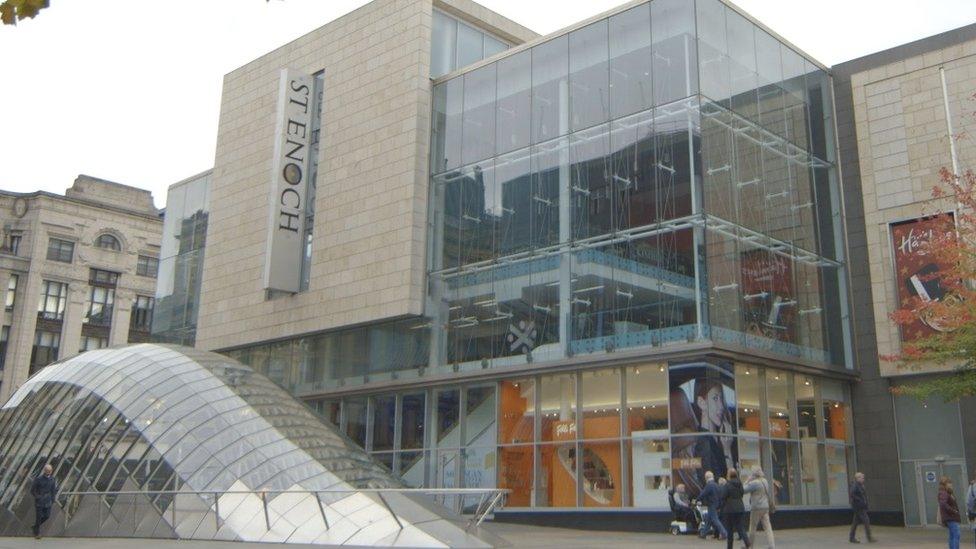

The St Enoch Centre is a large mall in the centre of Glasgow

Private equity firm Blackstone avoided tens of millions of pounds in UK taxes on property deals in Glasgow and London, the Paradise Papers show.

The documents reveal it used offshore companies to purchase and operate the St Enoch Shopping Centre in Glasgow and Chiswick Business Park in London.

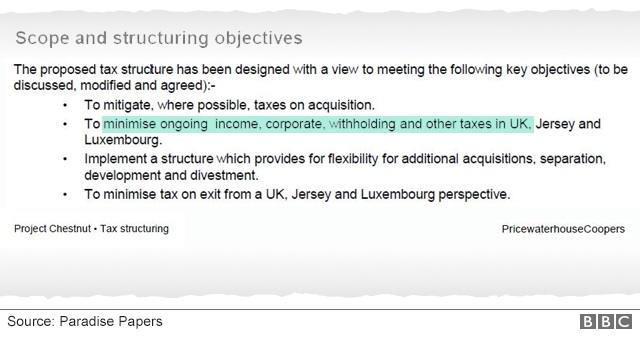

The papers show how accountancy firms mapped out strategies to minimise or avoid every significant tax.

Blackstone said its investments were "wholly compliant with UK tax laws".

Paradise Papers - Tax secrets of the ultra-rich

Property deals

Blackstone is one of the world's biggest private equity groups and its founder and chief executive Stephen Schwarzman is a close confidant of President Trump.

Leaked documents from the offshore law firm Appleby, seen by BBC Scotland, show for the first time how the group structured two major UK property deals.

Top accountancy firms issued long documents to Blackstone outlining how it could use trusts in the tax haven of Jersey and a complex structure of companies in Luxembourg for the purchase of both Chiswick Park and the St Enoch Centre.

Blackstone's Stephen Schwarzman is a close confidant of President Trump

There is no suggestion that the plans were illegal but campaigners the Tax Justice Network described the structures Blackstone used as an "economic fiction".

They told the BBC it was clear from the data in the papers that the principal purpose of the structures, which are virtually identical, was to avoid tax.

The leaked documents show the tax structure was designed to "minimise" taxes

'Losing revenue'

US tax expert Reuven Avi-Yonah, from the University of Michigan law school, said the documents gave a "rare" insight into company structures that even tax authorities did not often see.

"If HMRC becomes aware of the fact that this is a common type of structuring then they are more likely to challenge it because they will be aware they are losing a lot of revenue," he said.

Chiswick Park

Chiswick Business Park in west London is host to dozens of companies

Blackstone purchased Chiswick Park, a 33-acre office development in west London, in 2011 for £480m.

The majority of the site, which hosts the UK headquarters of companies such as Pokemon, Avon and shopping channel QVC, was sold to the Chinese government for £780m in 2014.

The data suggests Blackstone's tax structures allowed it to avoid about £19m in stamp duty on the purchase.

The tax structure also meant it could avoid tax of up to £30m annual rental income and capital gains tax on the sale of the business park, which could have been tens of millions of pounds.

St Enoch Centre

Blackstone still owns the St Enoch Centre

In 2013, the private equity giant also bought the St Enoch Centre in Glasgow, a large city centre shopping complex housing almost 100 stores, for about £190m.

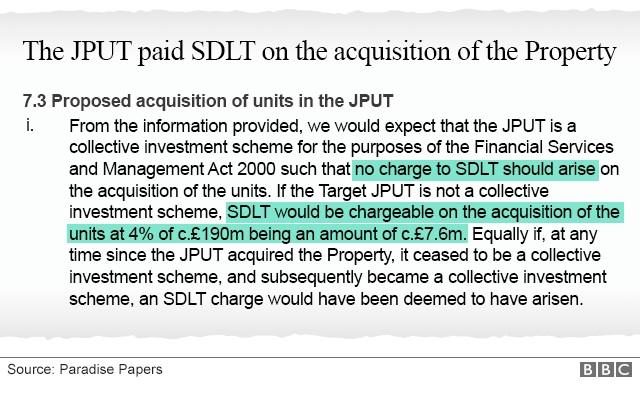

Documents show it would have avoided stamp duty of £7.6m and corporate tax on up to £10m annual rental income.

Source document

The documents show the Jersey trusts allowed no Stamp Duty Land Tax (SDLT) to be paid on St Enoch

Virtually identical

Both the St Enoch Centre, which Blackstone still owns, and Chiswick Park were already held in property trusts known as JPUTs, in the tax haven of Jersey, when it bought them.

This allowed the firm to purchase the properties without paying millions of pounds in UK stamp duty.

George Turner, from the Tax Justice Network, told the BBC: "What they are doing is buying into the trust so when the original owners sold the property to Blackstone, then they weren't selling the property itself.

"They were selling an interest in the trust that owns the property and because that trust is owned offshore, they can avoid stamp duty."

Under the tax structure revealed in the leaked documents, the Jersey trusts were owned and funded by a series of companies that Blackstone registered in Luxembourg.

Money for the purchase of the properties was filtered through the Luxembourg companies from central Blackstone funds in the form of inter-company loans.

The interest payments on these loans, which were effectively passed from one Blackstone company to another, could be written off against the profits of the rental income, meaning that minimal tax was paid in Luxembourg.

In the case of Chiswick Park, a 33-page document was provided by accountancy firm PwC outlining the structure to be used.

Another of the "Big Four" accountancy firms, Deloitte, issued a 67-page document for a similar tax structure for the St Enoch Centre.

The job of law firm Appleby, who held the documents seen by the BBC, was to implement the structures outlined by the accountants.

The central purpose of which was to avoid:

Stamp Duty - by holding the property in an offshore trust in Jersey, and maintain them as collective investment schemes

Income Tax - on the rental income, by funding the acquisition through a series of inter-company loans and Profit Participating Loans (PPLs), the interest payments on which can be used to write off against profits

Capital Gains Tax - on disposal, thanks again to the Jersey trust

George Turner, from the Tax Justice Network, said: "The language really is quite shocking in places because it's so clear and blatant what the intention is.

"What you have here is a whole myriad of companies being set up, mostly in Luxembourg but also you have this trust structure in Jersey, and it seems to be to all intents and purposes an economic fiction."

Inter-company loans

Profit from rental income at the St Enoch Centre had normally been about £10m a year.

The structure advised by Deloitte allowed Blackstone to turn that into tax free income, by writing it off against interest charges generated from the loans its companies had made to each other.

In some years, just a few thousand pounds appears to have been paid by the Blackstone Luxembourg companies owning St Enoch and Chiswick.

Mr Turner said: "What appears to be happening is that the rental income which is coming in, the companies receiving that are then borrowing huge amounts of money from other companies which are part of the Blackstone Group.

"Now when they borrow that money, they need to pay interest on it and those interest payments destroy any profitability in those companies.

"They're borrowing money from themselves and they can claim a tax deduction on that."

Blackstone said: "Blackstone's investments are wholly compliant with UK and international tax laws and regulations.

"The property investment structures in question were acquired from institutional investors and are of a type commonly used for decades for investments in UK real estates, including by listed companies and a variety of institutional investors, and were adopted after appropriate advice was taken from leading tax and legal advisors."

Deloitte, which advised on the St Enoch purchase, declined to comment.

PwC, who advised on Chiswick Park, said "The advice we provide is given in accordance with all applicable laws, rules and regulations, including proper disclosure to tax authorities."

Reporting team: Mark Daly, Calum McKay, Ian Bendalow and Rachael Miller.

The papers are a huge batch of leaked documents mostly from offshore law firm Appleby, along with corporate registries in 19 tax jurisdictions, which reveal the financial dealings of politicians, celebrities, corporate giants and business leaders.

The 13.4 million records were passed to German newspaper Süddeutsche Zeitung, external and then shared with the International Consortium of Investigative Journalists, external (ICIJ). Panorama has led research for the BBC as part of a global investigation involving nearly 100 other media organisations, including the Guardian, external, in 67 countries. The BBC does not know the identity of the source.

Paradise Papers: Full coverage, external; follow reaction on Twitter using #ParadisePapers; in the BBC News app, follow the tag "Paradise Papers"

Watch Panorama on the BBC iPlayer (UK viewers only)

Watch Scotland's Paradise Papers on Tuesday at 19:00 on BBC One Scotland.