Scottish first-time buyer activity 'bounces back'

- Published

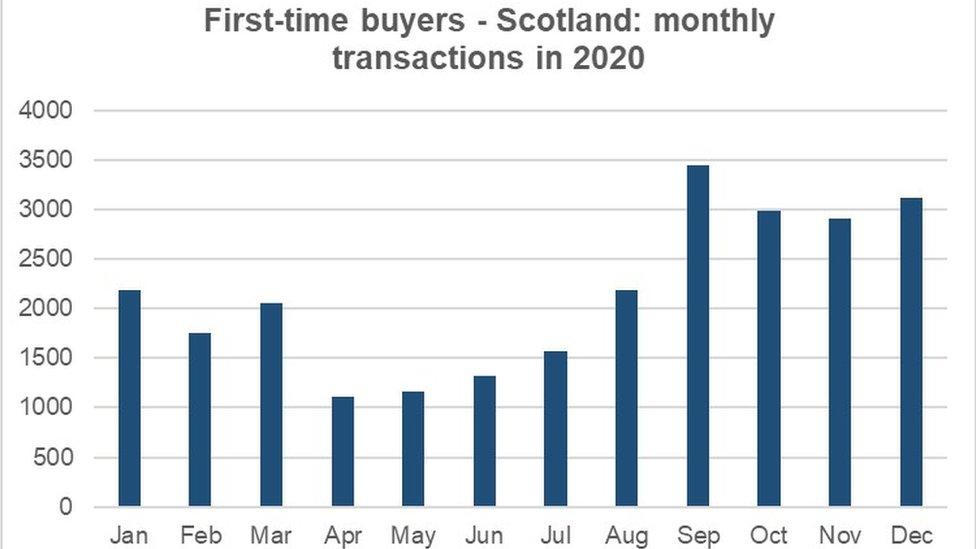

The number of first-time buyers in Scotland bounced back in the second half of last year, according to Bank of Scotland research.

Transactions jumped by 69% after the housing market reopened following the first national lockdown in the spring.

But overall the number of transactions in 2020 still fell year-on-year by 21%, to 25,826.

First-time buyers accounted for 50% of all homes purchased with a mortgage for the fourth year in a row.

Looking across the UK, Northern Ireland (-23%) and Wales (-23%) experienced the biggest decreases in the number of first-time buyers last year.

The average price paid by a first-time buyer in Scotland in 2020 rose by just over £2,100 to £155,411. This compared with the UK average of £256,057.

Figures from the Registers of Scotland, external show the average price of a property north of the border was £163,703 in November last year.

Bank of Scotland said the average amount put down by a first-time buyer in Scotland rose year-on-year by almost 19% to £35,745.

Meanwhile, East and North Ayrshire remained the most affordable areas in Scotland for first-time buyers, at just 3.2 times the average local salary for a home.

The City of Edinburgh took over from Midlothian as the least affordable area, with the average property price at 4.9 times average earnings.

Bank of Scotland mortgages director Graham Blair said: "It's no great surprise that the overall number of first-time buyers fell last year, as the property market effectively ground to a halt during the first national lockdown.

"However, the underlying strength of the market was made clear in the second half of 2020, as activity bounced back sharply as the country opened up again.

"While Scottish first-time buyers may have been spared the steep increases in average purchase price seen elsewhere over the last 12 months, the need to raise an ever-bigger deposit is still a significant barrier to home ownership."

Related topics

- Published3 September 2020