Q&A: How uneven is steel's 'level playing field?'

- Published

A level playing field? Can Port Talbot steel compete?

The 750 job losses at Port Talbot are another blow for the steel industry, which has lost 5,000 jobs in the last year.

Tata bosses made clear on Monday they do not want bail-outs or state aid but specific actions to give the industry a "level playing field".

What are they and how bumpy is that field?

Help with energy costs

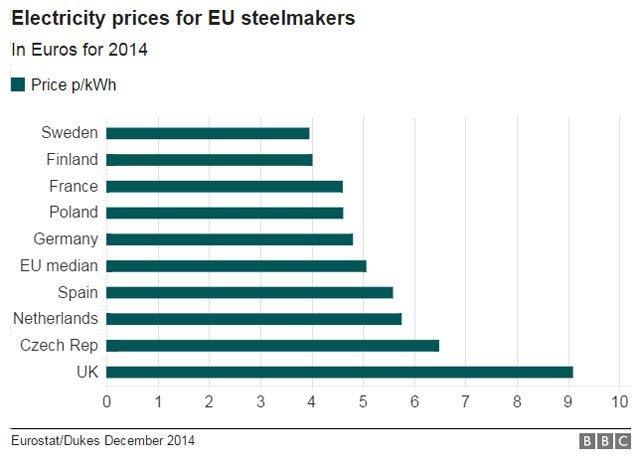

Port Talbot steelworks uses as much energy as the city of Swansea. Tata's electricity bill for Wales last year was a whopping £60m. So it is important, especially as its competitors in Europe are paying half as much.

Why are our industries paying more? Heavy users of electricity in the UK have had to foot a larger share of the bill for the UK's policies to cut carbon emissions.

The UK government has been under pressure for years to lighten that load with compensation. Finally, it got the green light from Europe last month. But the £410m a year has still to reach the steel companies.

Help with procurement

Hinkley C will cost £24.5n to build

There has been an argument that the UK steel companies should get more help winning work on major projects, such as the new nuclear plant being built at Hinkley Point just over the Bristol Channel from Port Talbot.

It will need 200,000 tonnes of steel just to reinforce the concrete for the station. That is the tip of the iceberg.

New government guidelines out last October recommend that the social implications of bids - such as unemployment in a disadvantaged area - and local supply chains should be taken into account.

There has been criticism that other European producers have had more support from their governments.

Tackle 'dumping'

We have heard a lot about China, but why?

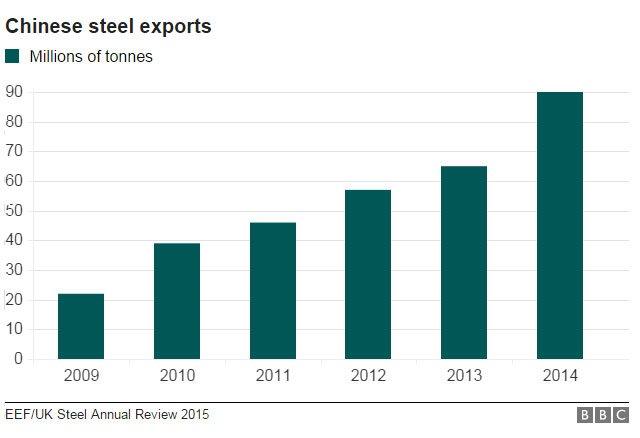

China is the world's biggest steel producer but it has had economic problems at home, with less demand for household products. So it is claimed, Chinese steel - mostly from state-owned companies - is being sold below cost price in the UK.

Chinese steel exports have been increasing steadily and are expected to have exceeded 100 million tonnes in 2015.

Inside a steel export factory in Taiyuan, China

Last September for example, China exported 11.5 million tonnes - in one month that is almost as much steel as the UK produces in a whole year.

The European Union has taken some action but there is criticism it has been too slow and the UK government could have done more to put the pressure on.

MPs holding an inquiry in December said successive governments should have done much more to press for "accelerated action" by the EU.

UK Business Minister Anna Soubry admitted on Monday there was more to do on "dumping" and she is pushing the EU to speed up its investigation into the issue so more anti-dumping duties can be brought in quickly. But the whole process could take up to two years.

The Chinese problem has also underlined an over-supply of steel worldwide - with consumer demand for cars, new houses and products like washing machines - still not picking up enough.

Global demand for steel is set to remain sluggish, falling by 1.7% in 2015 and rising by just 0.7% in 2016.

On top of that, the pound is strong, which makes imports cheaper. Last summer, sterling reached a seven-year high against a basket of currencies.

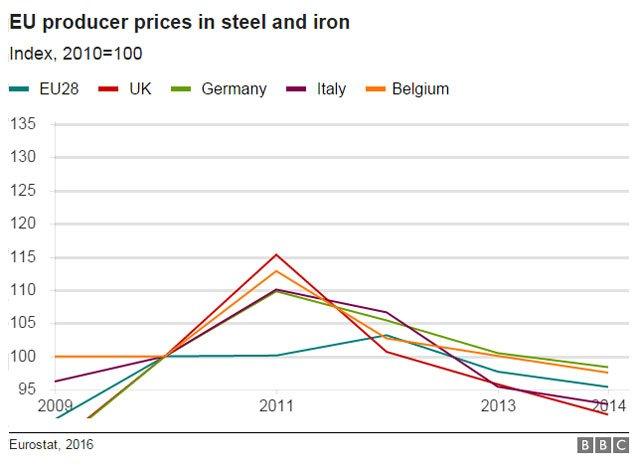

Market prices for steel fell steadily in 2014 - coil products falling 11% from €452 (£348) per tonne in January to €403 (£310) per tonne in December.

The graph above shows how the price has fallen for UK steel more steeply than other EU nations.

Help with business rates

Tata paid £26m business rates for its Port Talbot plant last year

Steel companies in the UK are paying up to 10 times the amount their competitors in Europe are billed for, according to unions and industry body UK Steel.

One reason is that in the UK, the value of machinery is taken into account, not just the factory buildings.

The business rates that Tata pays for Port Talbot alone are £26m a year.

Ironically, when it invested £185m in a new blast furnace in 2012, that put up its business rates.

MPs said this situation facing UK steel producers was "perverse"

Both UK and Welsh governments are reviewing business rates.

But it is complicated working out who should be helped and who should not.

Normally, rates can only be cut for whole industries, not just one company, and that "makes it expensive as far as government is concerned", First Minister Carwyn Jones told AMs on Tuesday.

So can we level out soon?

With Chinese imports doubling last year and no prospect that they will slow down soon, even with some of the changes being proposed, steel producers in Wales will face fierce competition in the market place.

- Published19 January 2016

- Published18 January 2016

- Published18 January 2016

- Published18 January 2016

- Published30 March 2016