Where are Liberia's missing millions?

- Published

Liberians are angry about the apparent disappearance of state funds - and are planning a protest march on Friday to demand answers.

Their anger centres on two scandals:

Revelations last year that 15.5bn Liberian dollars ($104m, £82m) of freshly minted currency had disappeared from Liberia's ports

The mismanagement of a 25m US dollar cash injection into the economy last year.

What happened?

In September 2018, local media reported that shipping containers filled with newly printed Liberian dollars from Swedish banknote manufacturer Crane AB disappeared from Liberia's entry ports between 2016 and 2017.

The Central Bank of Liberia denied the allegations and stated that the money was stored in vaults across the city.

There have been small demonstrations over the missing money over the last year

Just a few months before the revelation, President George Weah, who came into office in January 2018, announced that the central bank would pump $25m into the economy to replace older Liberian dollars.

The Liberian dollar has been losing value - or depreciating - since July 2017. This has led to higher import costs and inflation, which means that everyday goods have become much more expensive for the average person in the country.

The president's "mop-up" exercise, as it was dubbed, took place between July and October last year. It intended to reduce the amount of local currency in the economy to slow further depreciation.

But there were a number of concerns around the exercise and unanswered questions about the shipments of cash into Liberia. Two reports were commissioned to examine the details. The government's Presidential Investigative Team (PIT) completed one. Risk advisory firm Kroll, the other.

Both found major flaws in how government policy was implemented in each case, and neither the PIT nor Kroll were able to account for all of the newly printed Liberian dollars or the additional US dollars in the country.

What were the findings?

According to Kroll, only L$5bn of the total L$15.5bn was printed and distributed in line with Liberian law. The central bank did not receive legislative approval for the remainder of the cash, but entered into another contract with Crane who proceeded to print and deliver the money to Liberia anyway.

Kroll also found an excess of L$2.6bn was printed in addition to what was initially disclosed. The PIT's report recorded a similar finding.

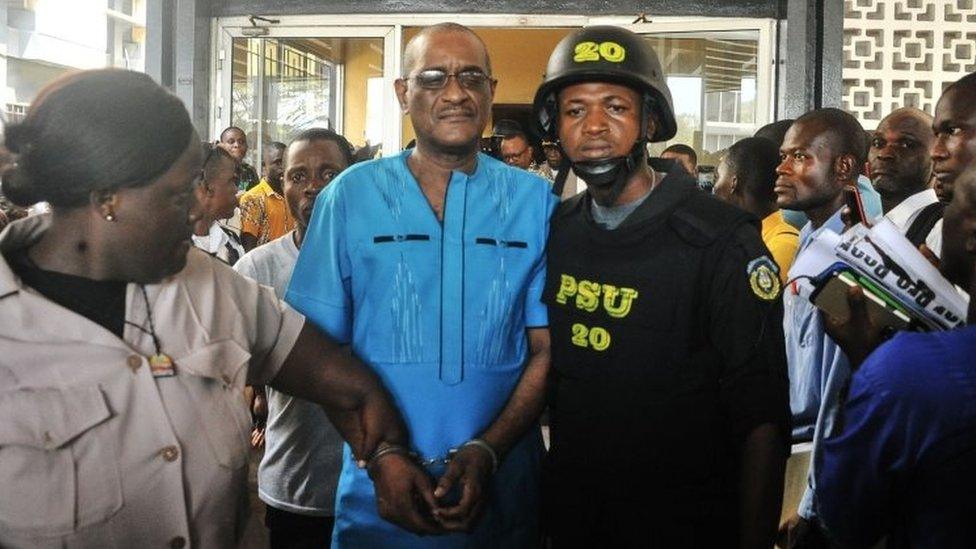

Charles Sirleaf (centre) is going on trial in the coming weeks

There is still little information on what happened to this excess, but the former executive governor of the Central Bank, Milton Weeks, and his former deputy, Charles Sirleaf - both in charge of the central bank when the notes were ordered - were arrested in March on the PIT's recommendation.

Mr Sirleaf, son of former President Ellen Johnson-Sirleaf, and Mr Weeks are due in court for the start of the trial in the coming weeks when they will be asked to enter a plea to the charges.

Ex-President Sirleaf said her son, who along with Mr Weeks has been released from prison but banned from leaving the country, had been unjustifiably and illegally charged. As for the US dollars pumped into the Liberian economy, this is where each reports differs slightly.

According to Kroll, the central bank sold $15m for L$2.3bn. This means that US dollars replaced older Liberian notes in the economy. The PIT report, however, stated that in addition to the $15m, another $2m was sold to oil and gas company Total.

But the PIT also outlined that 15 of the companies listed by the central bank to have taken part in the "mop-up" exercise denied any involvement. Another eight companies listed by the central bank were not in operation when the PIT made their visit.

So where has all the extra money gone?

As for the extra L$2.6bn printed "the most likely answer is that it is in the pockets of self-interested individuals," says Euler Bropleh, a Liberian national and founder and managing director of VestedWorld, a private equity firm that invests across Africa.

This has not yet been proven and remains speculation at this point.

You may also be interested in:

As for the $15m to $17m as part of the "mop-up" exercise, this may be even harder to calculate. While some of the money was distributed to a number of companies, proper records were not kept.

This is because the distribution of cash "deviated from conventional best practice", according to the PIT. For example, many records were written by hand, which could lead to a number of errors.

According to Kroll, this exercise has left the country open to "potential misappropriation of banknotes, potential opportunities for money laundering and potential execution of transactions with illegal businesses".

In other words, the money may never be accounted for. But it doesn't end there.

President Weah told the BBC on the anniversary of his first year in office that the missing money, more than $100m of newly printed cash, was being investigated

The BBC reported that the president received a letter from nine ambassadors, concerned that his government was taking money reserved for programmes funded by foreign donors from the central bank.

The World Bank has also complained that millions of dollars was removed from accounts earmarked for providing drinking water or for projects such as responding to the Ebola crisis. Calculating where all of Liberia's missing money is will require another rigorous audit, which the president has requested.

Meanwhile, the PIT recommends a demonetisation exercise - the withdrawal of current Liberian dollars from circulation and replaced with an alternative - to cut illegal activity and stabilise the economy.

What is happening now?

While one of the main aims of Liberia's policy makers was to stop the currency from losing any more value against the dollar, their actions have actually had the opposite effect.

Of the newly printed notes, Kroll recorded that more than L$10bn was fed into the Liberian economy without withdrawing any older notes. Of the "mop-up" money, $5m was also pumped into the economy without any withdrawal of local currency.

In fact, Kroll also reported that the old Liberian dollars were reintroduced into the economy within six months of being removed from circulation.

"Inflation continues to rise and the Liberian economy has tanked," says Taa Wongbe, an executive member of the Alternative National Congress and senior adviser to the leader of the opposition party.

"On the fight against corruption, the needle has not moved forward dramatically and we expect change," he says.

It is a sobering situation for the government as Mr Bropleh warns that people will not want to take the risk of investing in Liberia at the moment, so the economy may struggle further.

For the protesters, their hope is that the next audit will allow the president and the government to take action on policy makers that are yet to be held to account.

- Published13 February 2024

- Published19 February 2019

- Published27 September 2018