India rupee: Opposition say cash crackdown was disaster

- Published

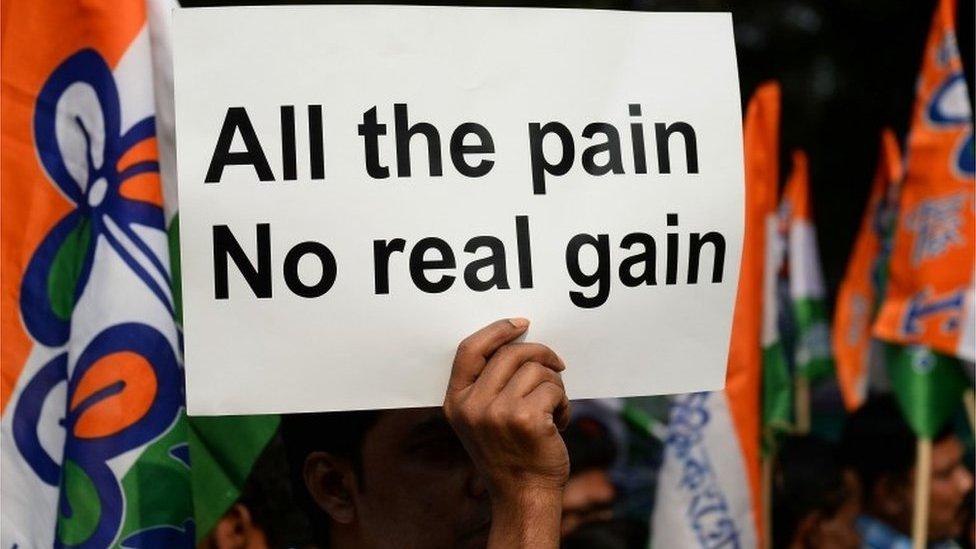

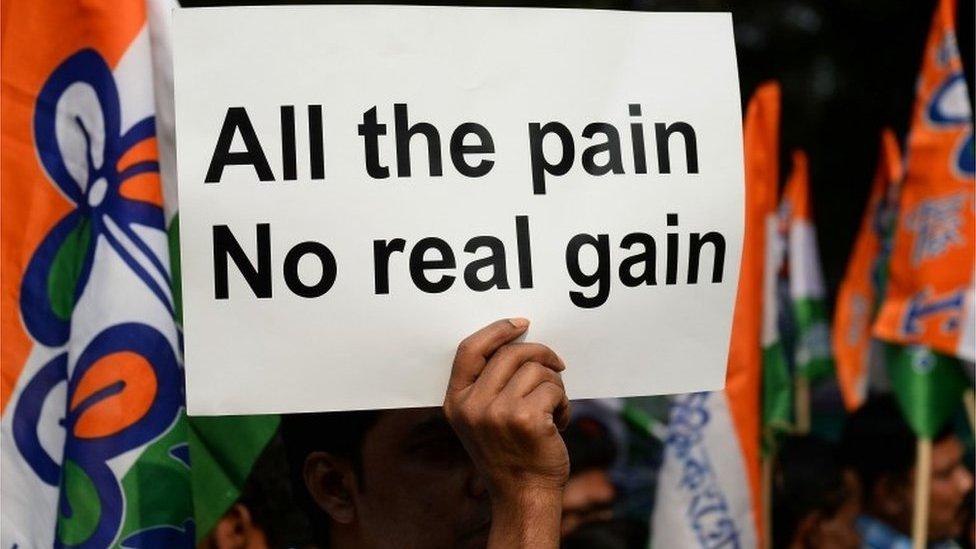

The opposition say the measure "ruined" the economy

Opposition parties in India have rounded on the government, calling its crackdown on illegal wealth a disaster.

Almost none of the currency banned in the move was flushed out of the banks, central bank data showed, external on Wednesday.

The Congress party demanded an apology from Prime Minister Narendra Modi, who had promised a "surgical strike" on so-called black money.

It said India's credibility abroad had been "dented". The government hit back, predicting boosted tax revenues.

The row came after the annual Reserve Bank of India (RBI) report showed that despite last year's surprise ban on high-currency notes, a total of 15.28tn rupees ($242bn) - or 99% - of the money had made its way back into the banking system.

Ministers had hoped "demonetisation" would make it difficult for hoarders of undeclared wealth to exchange it for legal tender.

New bank notes were printed to replace those taken out of circulation

Former Congress finance minister P Chidambaram said the policy had "not only dented the institutional sanctity of RBI, but also credibility of India abroad. The PM should apologise to the nation."

Congress vice president Rahul Gandhi tweeted that the policy had "ruined" the economy.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Another opposition leader, Mamata Banerjee, who is the chief minister of West Bengal state, said the bank data pointed to a "big scam".

On Mr Modi's tactics, respected journalist Shekar Gupta said it was a political "stroke of genius" - but economically a "complete failure".

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Current finance minister Arun Jaitley countered, external the criticism, saying the economy would benefit in the medium and long term.

"The fallout of demonetisation is on predicted lines... the fact that money got deposited in banks doesn't make it legitimate money," he said.

He added that many people had been brought under the tax net, partly as a result of the policy.

'Why no fury in India?'

Justin Rowlatt, BBC News, Delhi

You might imagine that people here would be angry at the news that Narendra Modi's audacious attempt to crack down on the scourge of "black money" had failed.

The surprise cancellation of virtually all the country's currency caused huge disruption. So why hasn't the country risen up in fury?

A day after it was revealed that virtually all the cash had been returned, the story barely makes the front pages of most television news and newspaper websites.

That's probably in part because lots of people find all the big numbers and complex details difficult and - frankly - dull. Another reason is that Mr Modi has very successfully spun his demonetisation as a bold attempt to strike a blow to the rich and powerful on behalf of the poor.

Read more: Why aren't Indians more angry over note ban failure?

Queues for cash

There were chaotic scenes as banks ran out of cash after the ban on 500 ($7) and 1,000 rupee notes, which accounted for about 85% of the money in circulation.

Announcing the policy on 8 November last year, Mr Modi had told the nation its aims were to target both counterfeit currency and "black money". The old tender became illegal within hours.

But within weeks it became clear that more money was coming back than the government expected. Many people who had "black money" found others - who did not - to deposit savings for them and got round the rules, correspondents say.

Many low-income Indians, traders and ordinary savers who rely on the cash economy were badly hit.

Agriculture, the rural economy and property - which rely largely on cash transactions - were sectors hit by the ban.

It also contributed to a slowdown in economic growth in the first quarter of this year.

But some analysts point out the policy did have some positive aspects, including injecting cash into the banking system which had brought the cost of loans down.

The opposition criticised the move, but failed to dent government popularity

Few observers think the bank figures will damage the government, which has fended off criticism of its cash crackdown while making electoral gains, including a sweeping victory in crucial Uttar Pradesh state in March.

- Published31 August 2017

- Published30 August 2017

- Published10 November 2016

- Published24 November 2016

- Published10 November 2016