Viewpoint: Modi's currency gamble damaged Indian economy

- Published

The 500 and 1000 rupee notes were scrapped to target so-called 'black money'

On 8 November 2016, Indian Prime Minister Narendra Modi announced that high value currency notes would be withdrawn from the financial system overnight. He said it was part of a crackdown on corruption and illegal cash holdings. A year later, economist Praveen Chakravarty looks at the legacy of the controversial move.

Prime Minister Narendra Modi decided to extinguish 86% of the cash in the country overnight.

He cancelled all 500 ($8; £6) and 1,000 rupee notes and replaced them with a newly designed 500 rupee and a newly introduced 2,000 rupee note, This move was erroneously described as demonetisation and the name has stuck. Technically it is not demonetisation but a refurbishment.

Liquidity crisis

This move impacted more than a billion people. The "great Indian demonetisation" of 2016 will rank among the most impactful economic policy decisions of any country in recent history.

In his speech on 8 November, Mr Modi said the primary motives for demonetisation were threefold - to eradicate black money, remove counterfeit currency, and stop terror financing. He embarked on a three-day state visit to Japan the morning after the announcement.

By the time he returned, all hell had broken loose.

There were serpentine queues of people to withdraw their own cash from bank ATMs. Millions of families were left stranded with no cash. Weddings were cancelled, small shops downed shutters and economic activity was disrupted. There was a crisis of liquidity. Stand-up comics were writing new parody scripts.

How do Indians rate their government's cash ban, one year on?

Indians were forced to queue up in large numbers at banks across the country

This should not have surprised anyone since more than 95% of all consumer transactions in India are in cash.

Mr Modi returned from Japan and immediately sought to address the people of India about the state of disarray.

He now claimed that demonetisation was needed to propel India to a cashless and digital economy.

In speeches on demonetisation that Mr Modi gave after his return from Japan, he used the phrase "cashless or digital" three times more than the phrase "black money" while in his 8 November announcement, there was no mention of "cashless or digital" at all.

Within a matter of weeks, "demonetisation" went from being an attempt to flush out undeclared wealth to a magic wand to turn a poverty-stricken nation into a cashless economy. The bravado was both admirable and laughable.

Ironically, Japan, the country that Mr Modi visited soon after his exercise to ostensibly rid India of its cash 'fetish', has the highest cash to GDP ratio of all major economies. It is unclear why a pursuit of a cashless economy should suddenly be India's most important economic priority.

This change in narrative was inevitable since the three premises for the demonetisation exercise were dubious to begin with.

Demonetisation could not have eliminated black money since it was well documented by various research studies that less than 6% of illicit wealth in India was held in cash.

So, invalidating 90% of the stock of currency notes to catch 6% of illegal wealth was a clear case of using a hammer to kill a fly.

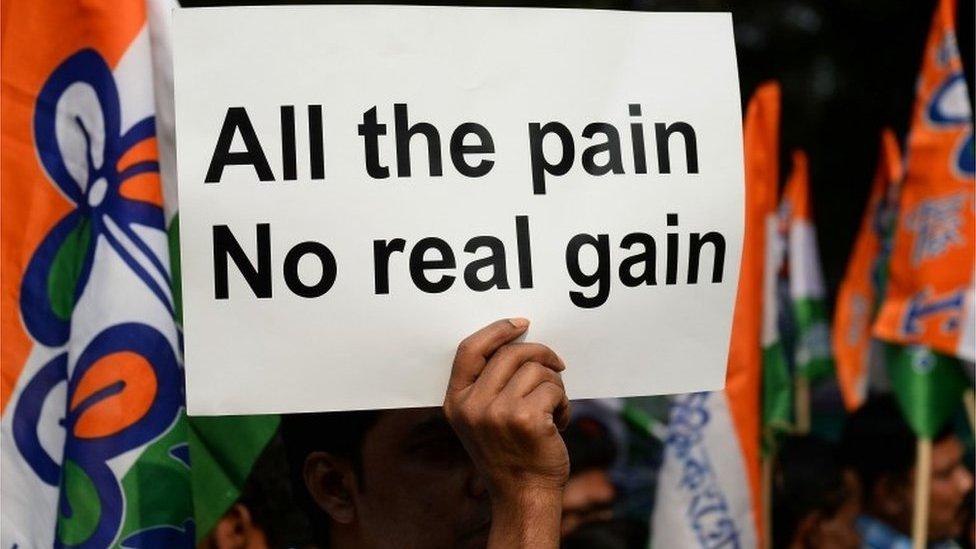

Opposition parties protested against the move

The rationale of a crackdown on counterfeit notes was also misleading since India's central bank's own estimate was that fewer than 0.02% of all currency notes in circulation were fake. Counterfeit currency notes are a universal and perennial problem which is best addressed through periodic design changes, not through demonetisation.

The third reason cited by Mr Modi for the measure was that India's share of high value currency was inordinately large which aided terrorist financing. This is again fallacious.

India's stock of high-value currency was growing in line with GDP and the share of such currency in India's GDP remained constant at around 9% for half a decade.

Further, there is no evidence that rising stock of high value currency had increased terror incidents.

Unclear rationale

It was thus evident that the economic rationale for demonetisation was not sound but perhaps there was some other rationale for this mammoth exercise that one is left to speculate upon.

While the rationale is still unclear, so is the precise quantum of the costs.

Much attention has been paid to how demonetisation slowed the economy down, and various anecdotal reports or surveys about how it caused joblessness.

But it is hard to infer much in the way causal relationships from headline GDP numbers alone. It is perhaps more important to analyse the economic impact of demonetisation by various sectors of the economy.

The three sectors that are most prone to an acute shortage of liquidity and that account for half of India's gross value added (GVA) and more than three-quarters of all employment are agriculture, manufacturing and construction.

GVA measures how much money is generated through goods produced and services delivered.

India introduced new 500 and 2,000 rupee notes after the currency ban

Using sectoral GVA data, my analysis shows that these sectors were growing at a steady state of 8% nominal rate - a rate not adjusted for inflation - in the four quarters before demonetisation.

After demonetisation, this growth slipped to an average 4.6% in the subsequent two quarters.

Using this fall in growth, one can estimate the potential impact of demonetisation on economic output in these three sectors. This works out to roughly $15bn (£11bn) or 1.5% of GDP. This is still a very rough estimate but places in context the narrative of job losses post demonetisation as these are the most employment-intensive sectors.

Unintended gains

There have also been some unintended gains due to demonetisation.

Banks have been flooded with deposits. This has helped keep interest rates low.

Most importantly, this has helped the government bail out India's highly indebted state-run banks through an elaborate arrangement called recapitalisation bonds.

There has also been a spurt in digital transactions and it is argued that India will become less cash-dependent though the jury is still out on that.

Overall, India's grand demonetisation saga is not done yet.

It has caused tremendous tangible and intangible damage that will take a long time to unravel.

Worse, we still do not know the precise reasons or the modus operandi of this massive decision.

One can only hope that other developing countries learn from India's experience and tread the path of economic policymaking in a more nuanced manner.

Parveen Chakravarty is Senior Fellow at IDFC Institute, a Mumbai-based think-tank

- Published10 November 2016

- Published14 November 2016

- Published17 November 2016

- Published11 November 2016

- Published24 November 2016

- Published10 November 2016