Greece bailout talks: Compromise possible, says Merkel

- Published

Both the Germans and the Greeks have suggested an agreement can be reached

German Chancellor Angela Merkel has said a compromise is possible in the stand-off with Greece over its bailout terms.

But Mrs Merkel told reporters as she arrived for a conference with other EU leaders that "Europe's credibility depends on us sticking to rules".

Greece opposes extending its bailout deal, saying it is damaging their economy.

On Wednesday, talks with other eurozone members failed to reach an agreement.

However both sides said there was still hope for a deal. Eurogroup President Jeroen Dijsselbloem said the talks had been "constructive".

The Greek Prime Minister Alexis Tsipras said as he arrived in Brussels for the summit that he was "very confident" a solution could be found to what he called the EU's "humanitarian crisis".

Mrs Merkel suggested there was negotiating room: "Europe always aims to find a compromise and this is the cornerstone of Europe's success."

Analysis: BBC Europe Editor Gavin Hewitt

All are aware that the clock is ticking.

If there is not an agreement within two weeks to extend the current bailout then Greece will not be eligible for a €7bn loan and shortly after will run out of money.

At the moment there is deadlock. Prime Minister Alexis Tsipras cannot go back to the Greek people if the existing deal is extended.

He will be accused of having misled the voters.

The Germans, the Dutch, the Spanish and others are not prepared to tell their voters that the Greeks are getting a new deal.

Peston: Greece and the Eurogroup need a marriage counsellor

Mrs Merkel said: "Compromises are made when the advantages outweigh the disadvantages and Germany is prepared to compromise."

"However, we also have to make clear that Europe's credibility depends on us sticking to rules."

Germany has been strongly criticised in Greece, where it is seen as the key backer of the austerity policies the new Greek government has pledged to ease.

Greeks have rallied in support of the Syriza-led government.

High stakes

Eurozone finance ministers are due to meet again on Monday to try to reach an agreement.

The Greek government and the troika - the EU, International Monetary Fund (IMF) and European Central Bank (ECB) - are to hold talks ahead of the eurozone meeting to try to find common ground, said Simone Boitelle, a spokesperson of the Eurogroup.

The troika has been supervising Greece's massive bailout. But the new left-wing Syriza government was elected promising to renegotiate the bailout and has refused to accept the troika's conditions.

The government has proposed to overhaul 30% of its bailout obligations, replacing them with a 10-point plan of reforms.

It is asking for a "bridge agreement" that will enable it to stay afloat until it can agree a new four-year reform plan with its EU creditors.

However, Greece's creditors in the EU, led by Germany, have insisted that the terms of the bailout cannot be altered.

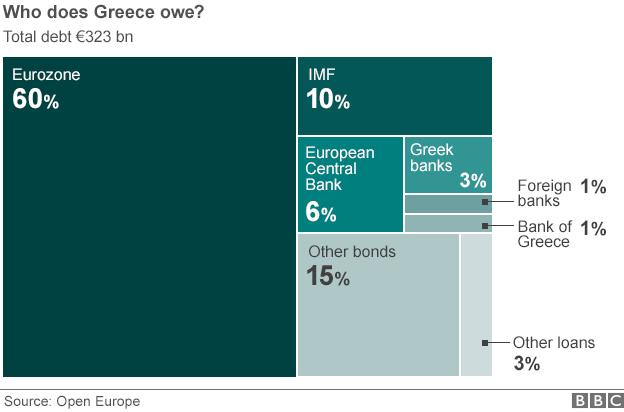

Greece's debt currently stands at more than €320bn (£237bn) - about 174% of its economic output (GDP).

The stakes of the talks over Greece's debt are high because of fears that a Greek default could push it out of the euro, triggering turmoil in the EU.

The Greek Defence Minister, Panos Kammenos, previously said Greece might seek funding from Russia, China or the US if it failed to reach a new debt agreement with the eurozone.

Key dates for Greece

12 February: EU leaders' summit in Brussels

16 February: Eurogroup talks to resume on renegotiating bailout

28 February: Current programme of loans ends

First quarter of 2015: Greece's funding needs estimated at €4.3bn by end of March

19-20 March: EU leaders' summit

20 July: €3.5bn bonds held by the European Central Bank mature

20 Aug: €3.2bn bonds held by the European Central Bank mature

- Published12 February 2015

- Published12 February 2015

- Published12 February 2015

- Published12 February 2015