Greece debt crisis: Tsipras announces bailout referendum

- Published

Alexis Tsipras: "The people must decide free of any blackmail"

Greece's prime minister has called a referendum on 5 July for voters to decide whether to accept a bailout deal offered by international creditors.

Alexis Tsipras made clear he was against the "unbearable" bailout plan.

Parliament is debating whether to ratify the vote, and some queues have been seen outside banks in Athens.

Eurozone finance ministers are meeting to discuss the crisis, and to decide whether to give Greece an extension of the bailout until after the vote.

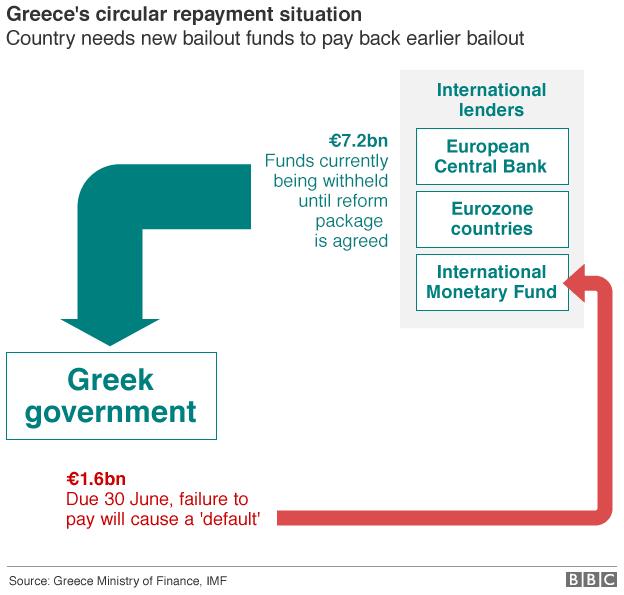

The current bailout expires on Tuesday, the same day Greece's IMF debt is due.

It is unclear what would happen if Greece does not get a temporary extension. Without a deal on the bailout, there are fears Greece's economy could collapse.

Some queues were reported outside banks in Athens

The head of Mr Tsipras's coalition partners, Panos Kammenos, called for calm amid reports that worried Greeks had begun queuing outside banks to take out their money. Many fear that Greece's central bank might start restricting withdrawals.

In a televised address, Mr Tsipras described the bailout plan as "humiliation" and condemned "unbearable" austerity measures demanded by creditors.

Analysis: Chris Morris, BBC News, Brussels

The government portrays the referendum as yes or no to austerity. The opposition says it is, in effect, yes or no to Europe. Some of them say the referendum itself is unconstitutional, and are urging the Greek president to reject it.

But Mr Tsipras will argue that he had no other option. He was elected to get a better deal rather than no deal at all. But no better deal was on offer.

As for Greece's creditors I think they will be one part flabbergasted, one part anxious, and one part wondering what on earth they do next.

But several eurozone finance ministers, arriving in Brussels for their fifth meeting on Greece in little more than a week, said there was no question of accepting Mr Tsipras's request to extend his country's current international bailout by a few days, to prevent the Greek economy collapsing before a referendum can be held.

Some of the ministers will now want to focus on Plan B instead - how to ring-fence Greece and protect the rest of the eurozone from any potential economic shocks ahead.

"I call on you to decide - with sovereignty and dignity as Greek history demands - whether we should accept the extortionate ultimatum that calls for strict and humiliating austerity without end, and without the prospect of ever standing on our own two feet, socially and financially," he said.

"The people must decide free of any blackmail," he added.

Greek Finance Minister Yanis Varoufakis tweeted in support of the referendum.

Some opposition figures on the other hand accused Mr Tsipras of using the vote to push Greece out of the EU.

A senior centre-left politician in Germany's coalition government, Carsten Schneider, called for the European Central Bank (ECB) to stop propping up Greece's economy with emergency injections amounting to $89bn.

BBC economics editor Robert Peston said that if the ECB continued its emergency support, some members of its governing council feared it would be breaking all central banking rules.

James Reynolds reports from Andros in Greece: ''The island worries that tourists will be put off by price rises and walk away for good''

Mr Tsipras was speaking hours after talks in Brussels, where the IMF and EU offered a five-month extension to Greece's bailout programme.

The proposal would have released €15.5bn of funding, €1.8bn of which would have been available immediately. However, that was conditional on Greece carrying out reforms.

German Chancellor Angela Merkel had urged Athens to accept what she called an "extraordinarily generous" offer.

Greek debt talks - main sticking points

Greece's debt dilemma explained in 75 seconds

Greece has refused to accept cuts to pension payments or public sector wages

The IMF is pushing for deeper spending cuts, not just more tax rises

A key point of friction is a special benefit paid to some low-income pensioners, which creditors want scrapped

Creditors also want a wider VAT base; Greece says it will not allow extra VAT on medicines or electricity bills, and has also resisted calls for VAT hikes on hotels and restaurants

Athens wants a concrete commitment to debt relief, something its creditors are not offering

The protracted negotiations are stalled over what reforms Athens is prepared to take, with disputes emerging on pensions and increasing Value Added Tax.

If Greece does default, it could exit the eurozone, with possible repercussions for the rest of Europe and the world economy.

Only once agreement is reached will the European Commission, European Central Bank (ECB) and International Monetary Fund (IMF) unlock the final €7.2bn tranche of bailout funds for cash-strapped Greece.

Greece has been in recession for much of the past six years. After winning elections in January, Mr Tsipras' left-wing Syriza party promised to end tough austerity measures.

Syriza says tough bailout conditions have impoverished Greece, fuelling unemployment - currently at more than 20% - and failing to reduce the massive debt pile.