Greece debt crisis: 'No new plan' as eurozone leaders meet

- Published

Greek banks remain closed and there is a €60 daily limit on cash machine withdrawals

The eurozone says Greece has submitted no new proposals to secure a deal with creditors, ahead of a key meeting of the group's leaders in Brussels.

It had urged Greece to submit fresh plans after its people rejected a draft bailout in a referendum.

Greece said it had proposed a few changes and that it wanted a deal based on "the mandate of the referendum".

The lack of a new plan angered some eurozone members, with Germany saying there was "still no basis" for talks.

Greece debt crisis: Latest updates

The Greek side gave a presentation on Tuesday at a eurozone finance ministers' meeting, which preceded the leaders' summit. However, there was no new written plan.

The Greek government said: "Today's Eurogroup was not supposed to take decisions but rather prepare for the summit."

German Chancellor Angela Merkel stresses that only days are left to secure a deal

It said proposals it had made last week were still on the table with a "few changes" and they would be discussed later on Tuesday and on Wednesday.

Eurogroup head Jeroen Dijsselbloem said, external Greece would be sending a new letter requesting short-term support from the European Stability Mechanism (ESM), a pot of money set up in 2012 to fund eurozone members in financial difficulties.

He said the Eurogroup would discuss this on Wednesday but that creditors would have to look at Greece's finances and debt sustainability to see "if we can formally start the negotiations".

All 19 eurozone members would have to agree to an ESM loan. As a vote would also have to be passed in the German parliament, Greece would need an emergency bridging loan in the coming days to tide it over.

New Greek Finance Minister Euclid Tsakalotos insisted there had been "progress" in the talks.

Greek PM Alexis Tsipras met German Chancellor Angela Merkel and French President Francois Hollande separately before the leaders' summit.

Analysis: Robert Peston, BBC economics editor

Alexis Tsipras stands by the letters he sent a week ago to the country's creditors setting out the €30bn of additional loans the country needs over the next three years to pay maturing debts, amending the creditors proposed pension and VAT reforms, and asking for investment from the pool of money created by Jean-Claude Juncker, European Commission president.

Mr Tsipras also wants a writedown of the country's massive debts - equivalent to 180% of GDP or national income - and a resumption by the European Central Bank of life-or-death emergency lending to banks.

Or to put it another way, very little of substance has changed in the Greek position over the last few days.

Which is why German Chancellor Angela Merkel is not exuding optimism that a way can be found to avert the catastrophe of the collapse of Greece's banking system, and its exit from the euro.

The result of the referendum had sparked fears of a Greek exit from the eurozone and the lack of a new written plan was criticised by some in the group.

Mrs Merkel said as she arrived for the leaders' summit: "We still do not have the basis for negotiations... it is not a question of weeks anymore, but a question of a few days."

Malta's Prime Minister Joseph Muscat said the leaders' summit was looking like a "waste of time".

His Dutch counterpart, Mark Rutte, said: "It is really up to the Greek government to come up with far-reaching proposals. If they don't do that, then I think it will be over quickly."

Analysis: Gavin Lee, BBC News, Europe reporter

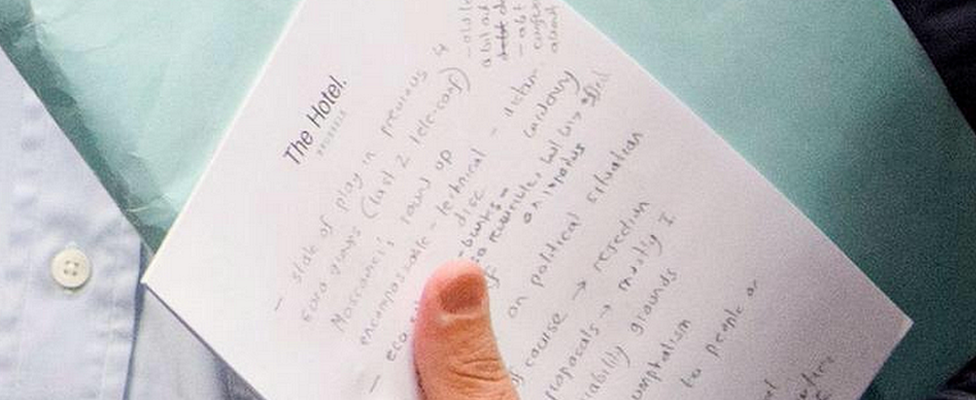

Mr Tsakalotos accidentally revealed his notes on hotel paper on Tuesday

The first full day at work for Greek finance minister, Euclid Tsakalotos, and he's already found out what it's like to slip-up with the paparazzi. Mr Tsakalotos was photographed with scribbled notes in hand, face-side up - private notes now open to public scrutiny on social media.

The scribbled notes - written in English, conveniently for the press - may not be legible enough to make full sense of his opening gambit but they certainly reveal the tone. The words 'no triumphalism' can be deciphered, attention is drawn to 'AT' - presumably Alexis Tsipras' message on the night of the referendum, and there's also reference to the proposals being rejected "mostly on viability grounds".

There may be graphologists already studying his writing to get a sense of the man now a key player in determining the future of Greece. In the interim, Mr Tsakalotos may now be scribbling: "Note to self: keep cards close to chest."

Alexis Tsipras (left) stays positive as he meets other eurozone leaders

Mr Hollande and Italian Prime Minister Matteo Renzi have been more hopeful of a deal.

But Mr Hollande said Greece had to make "serious, credible proposals", adding: "We need speed. It's this week that the decisions have to be taken."

What is the European Stability Mechanism (ESM)?

Eurozone's only permanent bailout fund - financed by all 19 member states

Launched in Oct 2012, total lending capacity is €500bn (£355bn; $552bn)

Only lends if borrowing country agrees to fulfil strict economic conditions

ESM made loans to rescue banks in Spain (€41.3bn) and Cyprus (€9bn)

Germany is biggest ESM contributor (€190bn)

Mr Tsipras will address the European Parliament on Wednesday, a Greek government source said.

He has been reported to want Greece's vast €323bn ($356bn; £228bn) debt to be cut by up to 30%, with a 20-year grace period.

Germany has warned against any unconditional write-off of Greece's debt, amid fears it would destroy the single currency.

Greece's teetering banks have been shut since the last international bailout programme expired last Tuesday. One minister, George Katrougalos, said they were unlikely to reopen this week.

Jean-Claude Juncker told the European Parliament he was texting the Greek PM, after complaints about his phone use

The European Central Bank (ECB) is maintaining its pressure on the banks, refusing to increase emergency lending and ordering them to provide more security for existing emergency loans.

Capital controls have been imposed, with people unable to withdraw more than €60 a day from cash machines.

The European Commission - one of the "troika" of creditors along with the IMF and the ECB - wants Athens to raise taxes and slash welfare spending to meet its debt obligations.

Greece's Syriza-led left-wing government, which was elected in January on an anti-austerity platform, said creditors had tried to use fear to put pressure on Greeks.

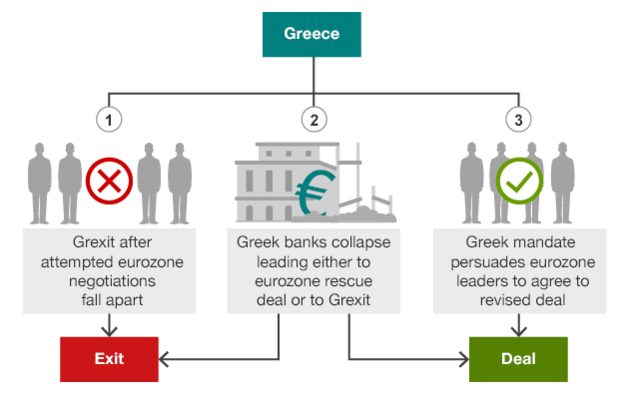

What are the scenarios for Greece?