Greece debt crisis: The final showdown

- Published

The outlook is bleak for Greece - and the rest of Europe - unless a debt deal is reached

The Greek road is littered with discarded deadlines. Moments of truth have come and gone.

Headline writers predicting Greece's departure from the euro have been made to look foolish as yet another meeting is scheduled.

But Europe's leaders have now called time on the endless circle of negotiations. The President of the European Council, Donald Tusk, said: "I have to say it loud and clear. The final deadline ends this week."

So Greece has five days to strike a deal and win more bailout funds. If it fails, then Europe's leaders have sketched out what they call the "black scenario": bankruptcy and the insolvency of the Greek banking system.

In Greece there is no fudging as to what is at stake. The headlines in Wednesday's papers read "Euro or Drachma on Sunday" and "Deal or Grexit".

'Critical moment'

So what must Greece do? Firstly, it has to deliver detailed reform plans by Thursday.

Those plans must include a formal application for a bailout under the ESM, the European Stability Mechanism. That will then be assessed by the European Central Bank (ECB), the International Monetary Fund (IMF) and the European Commission.

The application will then go to eurozone finance ministers on Saturday and from there to a full European summit on Sunday.

Alexis Tsipras is under intense pressure from his EU counterparts to come up with a proposal

At that meeting, Europe's leaders will take the final decision as to whether Greece qualifies for another bailout programme, or whether they will take a step which will hugely damage the reputation of the eurozone.

"I have no doubt," said Donald Tusk, "that this is maybe the most critical moment in our history, the EU and the eurozone."

Failure would be a scar on the legacy of German Chancellor Angela Merkel and would be a damning judgement on the whole policy of austerity.

If the meeting believes Greece has done enough, then there will be short-term bridge financing and the ECB will continue with emergency funding of Greek banks.

Almost certainly a way would be found for Greece to make a large payment to the ECB on 20 July. But all of this will be linked to Greece meeting certain benchmarks.

Alexis Tsipras left Tuesday's summit smiling. He believes he will get a deal to keep Greece in the euro. But the next few days will test his leadership.

He will have to set out his reform plan and the extent to which he is prepared to accept budget cuts as was demanded in the earlier EU/IMF plan which has now expired.

Pharmacist Antonios Tsalpatouros spoke to the BBC's Jasmine Coleman

The second problem is that in recent weeks and months, the Greek economy has deteriorated. It is now in freefall.

There is no panic buying, but shoppers are stocking up on basics like pastas, noodles and baby food. Chicken farms are struggling to pay for more chicken feed. Some pharmacists are reporting shortages.

There are questions for how long the gas company will be able to afford paying for energy imports. There are large numbers of tourists in Greece but some future bookings have been cancelled. The normal daily flow of business has been seriously disrupted.

As a result of this, Greece will be asked to commit to more economic reforms than before.

Persuading the doubters

The third challenge is getting a deal through the Greek parliament. One Greek paper on Wednesday had the headline: "They want an unconditional surrender".

But Mr Tsipras has come out of his referendum victory with increased authority and should be able to get parliament to back him. To do that, he needs to be able to offer the Greek people a way out of this crisis.

Most importantly, there will have to be some commitment to talks on re-structuring Greek debt, although Mrs Merkel has made clear it is out of the question that Greece's debts of €320bn will be written off.

There will have to be a third bailout and an offer of investments to boost growth.

Those three elements would probably be enough to persuade a majority of the doubters in Mr Tsipras' party.

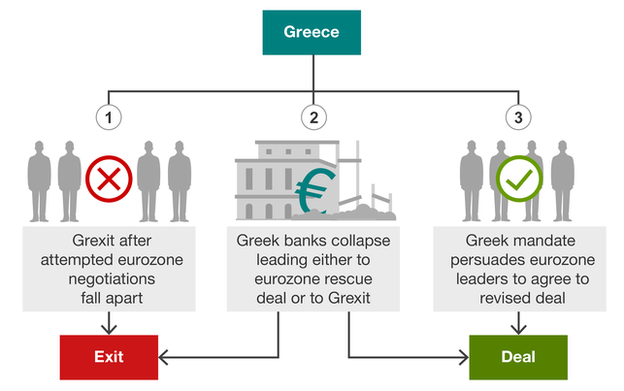

Greek crisis: What are the scenarios?

There are at least three - but at the heart of each of them is what will happen to Greek banks and to the emergency cash funding provided by the European Central Bank (ECB).

Over the next few days - once again - different crowds will demonstrate for and against staying in the euro.

The ECB will continue with its tight level of emergency funding so that the ATM machines can provide a trickle of funds and a banking collapse can be avoided.

Failure on Sunday - almost certainly - would lead to the ECB turning off support and Greece would be on its own. Already some European leaders have spoken of sending humanitarian missions to Greece but, however necessary, it would be a humiliating day for the European project.

It is still possible that the next few days will strain the fragile consensus reached by Europe's leaders. Beneath the surface there are differences between France, Italy and Spain on the one hand and Germany, the Netherlands, Lithuania and other northern countries on the other.

For Mrs Merkel, there is one principle that she will defend at all cost, that in the eurozone solidarity comes with conditions which have to be met.

The countdown has started to avoiding the "black scenario".