Apple tax ruling 'must not stand' says Enda Kenny

- Published

Enda Kenny said his government would appeal the European ruling with every expectation of success

The European Commission ruling on Apple's Irish tax payments is damaging to Ireland and could not be allowed to stand, Taoiseach Enda Kenny has said.

The Dáil (parliament) is debating the European ruling that the country granted undue tax benefits of up to €13bn (£11bn) to Apple.

It was recalled early following the decision by the Irish government to appeal the ruling.

Mr Kenny, the taoiseach (prime minister), said the ruling was wrong.

Why is Ireland refusing billions?

"Governments over the years have made clear, as this government has, that Ireland did not and does not do deals with corporates, large or small. It is not how we do business," he told the Dáil.

"Today, this house has an opportunity to send a strong message that we stand together in challenging the presentation that the commission has made, and that we are all determined that Ireland should continue to be at the forefront in efforts to improve and reform the international tax system."

The government would appeal the ruling before the European courts with every expectation of success, added Mr Kenny.

He said that while the "Revenue commissioners will now take the steps necessary to collect the sum involved as required, it will be held in escrow pending the final outcome of the legal proceedings".

Also speaking during the debate, Irish Finance Minister Michael Noonan said Apple had not been shown favouritism.

Analysis: BBC News NI Dublin correspondent Shane Harrison

Today's vote was always going to be a foregone conclusion once the main opposition party, Fianna Fail, indicated it would support the government motion in appealing the European Commission's Apple ruling.

It will mean that Enda Kenny's Fine Gael minority government, supported by Independents, will go to the courts in Luxembourg with the diverse support of the Irish parliament.

It will argue that it did nothing wrong and did not collude with Apple in a secret sweetheart deal, to help it avoid paying taxes in other countries.

But Sinn Féin and hard-left politicians and parties disagree and say the government should pocket the Apple money plus interest, and spend it on social services that have been reduced because of austerity.

While there is little sympathy for Apple and the low amounts of tax it has paid globally for those supporting the government, it comes down to short-term monetary gain or protecting the Republic of Ireland's good business name in the longer term.

The appeal will go ahead but it may be up to six years before we know the outcome.

"It is simply untrue that Ireland provided favourable treatment to Apple," said Mr Noonan.

"The reaction to the European Commission's decision has, at times, painted an outdated and unfair caricature of Ireland's position on tax.

"This is a caricature that is at odds with the evidence and which overlooks our proven track record in recent years.

"The facts show our constructive engagement at the international table, with matchless implementation of reforms ahead of many of our partner countries."

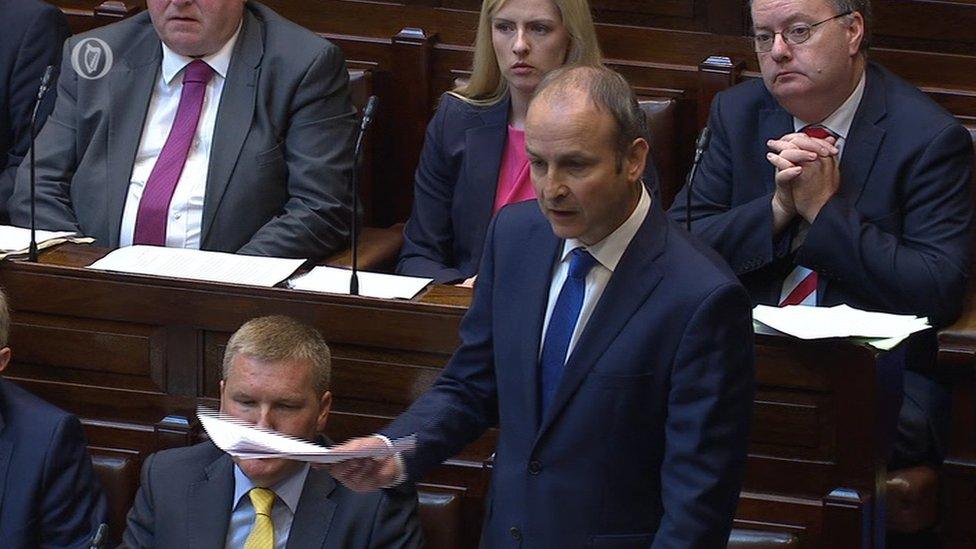

Micheál Martin said the European Commission had made an assertion not backed by any evidence

He said the European Commission ruling encroached on sovereign states' decisions on tax and contained contradictions on where Apple owed tax.

'No selective treatment'

Micheál Martin, leader of Fianna Fail, said it had not been shown that there had been "selective treatment for one company".

"A five-year investigation, including an unprecedented and targeted trawl of revenue files, has produced an assertion, but no evidence," he told the debate.

However, Sinn Féin leader Gerry Adams said there had to be fairness in taxation.

"There can't be one set of rules for some and different rules for others, with small and medium sized enterprises - the backbone of our economy - weighed down by government tax policies, while one very large company pays less than 1% corporation tax."

On Tuesday night, Dáil (parliament) members were given a 16-page Department of Finance document on the background to the ruling.

The ruling itself is confidential.

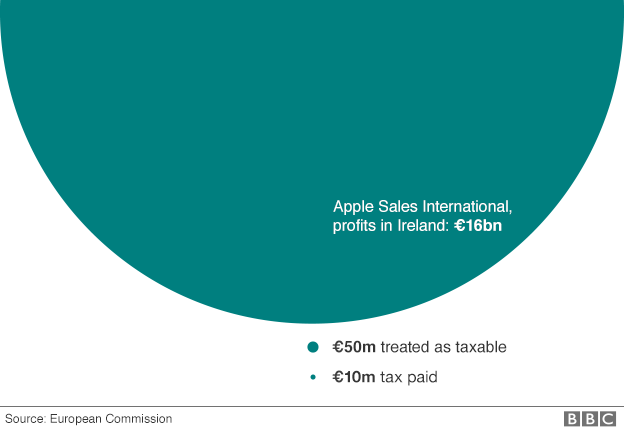

How Apple was taxed in Ireland in 2011

In 2011, as in previous years, every Apple product sold in Europe, Middle East, Africa and India was recorded as a sale by Apple Sales International in Ireland.

Under its tax arrangement, Apple Sales International then allocated the vast majority of its profits to a head office. According to the EU Commission, this head office existed "only on paper" and therefore its profits were not taxed. Only a small percentage of profits were allocated to the Irish branch of Apple Sales International.

As a result, the final 10 million euros tax paid by Apple was equivalent to a rate of 0.05% - this fell to 0.005% by 2014 as profits rose - far less than the 12.5% Ireland charges other companies.

Another company, Apple Operations Europe, also based in Ireland, operated in a similar way.

'Absolutely unbelievable'

Richard Boyd Barrett of People Before Profit told the Dáil it was "a farce" that the debate was being held despite the fact that members could not see the full European ruling.

"It's absolutely unbelievable that we're going to make a decision that has enormous implications for this state - to say no to 13bn euros - and we have not even got access to the ruling," he said.

Previously, Apple chief executive Tim Cook said he was "very confident" the ruling would be overturned on appeal.

He called the European Commission's decision "maddening" and "political".

However, European Competition Commissioner Margrethe Vestager rejected Mr Cook's claims.

Apple intends to appeal the European Commission's ruling demanding it pays €13bn in taxes to Ireland

She said it was "a decision based on the facts of the case, looking into Apple Sales International, how they are arranged within Ireland, and the profits recorded there".

- Published7 September 2016

- Published2 September 2016

- Published7 September 2016

- Published1 September 2016

- Published31 August 2016

- Published30 August 2016

- Published30 August 2016

- Published30 August 2016

- Published30 August 2016

- Published18 July 2018

- Published30 August 2016