Greek bailout crisis in 300 words

- Published

Greece emerges from eurozone bailout programme

Greece has emerged from controversial bailout programmes that came with years of austerity - here's a very quick guide on why this happened.

How did this start?

In 2008 the world's worst financial crisis in almost 80 years caused a global recession, external.

Many European countries had huge government debts but Greece was worst affected, with a spiralling spending deficit. It had borrowed much more money than it was able to make in revenue through taxes.

In 2010, the country revealed its sky-high deficit, external and was frozen out of bond markets.

What happened next?

Greece asked for a financial rescue by the European Union and International Monetary Fund.

Bailouts - emergency loans aimed at saving sinking economies - began in 2010.

Greece received three successive packages, totalling €289bn (£259bn; $330bn), but they came with the price of drastic austerity measures.

What about the people?

For many Greeks - especially the young - the years of economic hardship were severe.

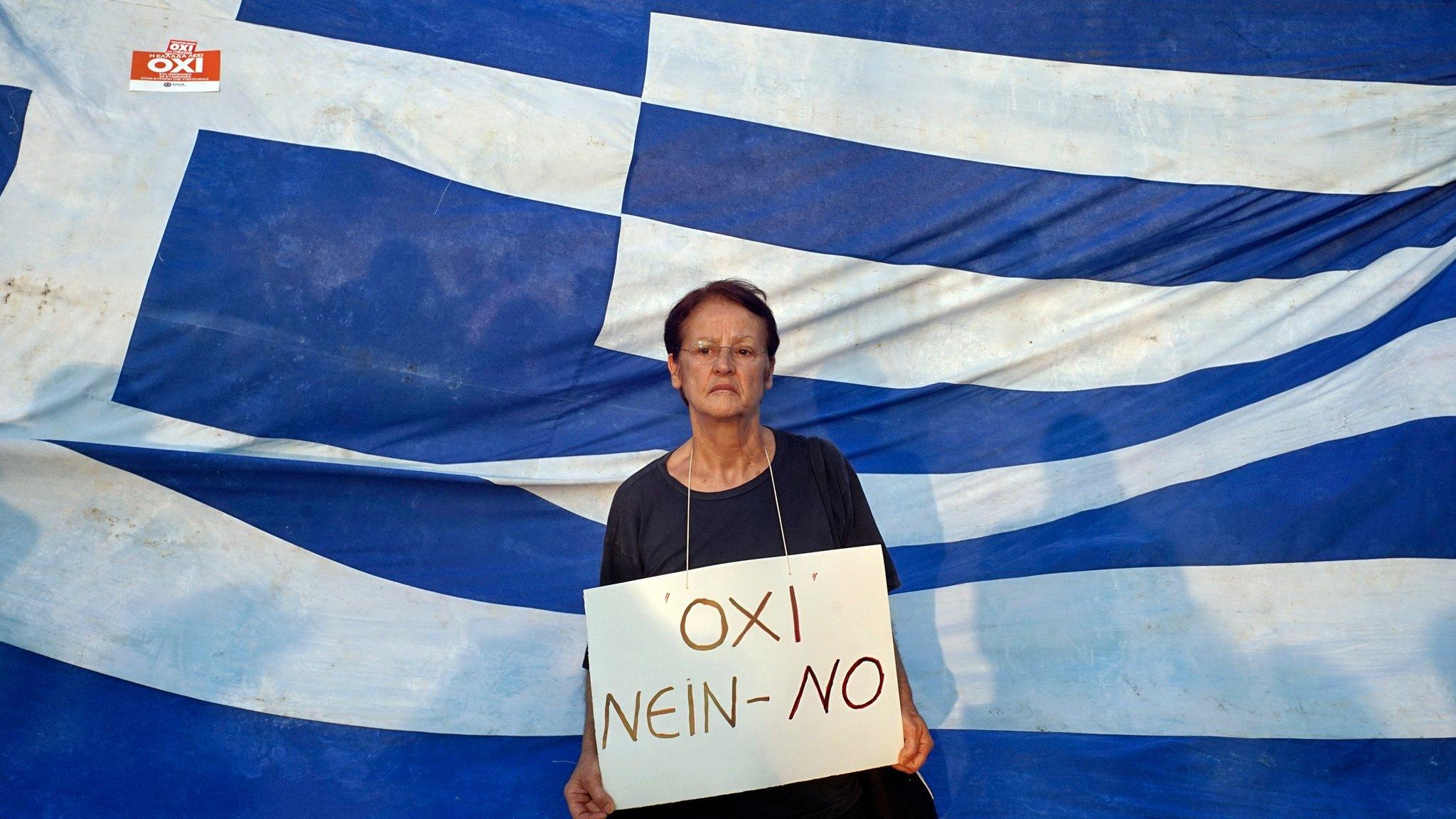

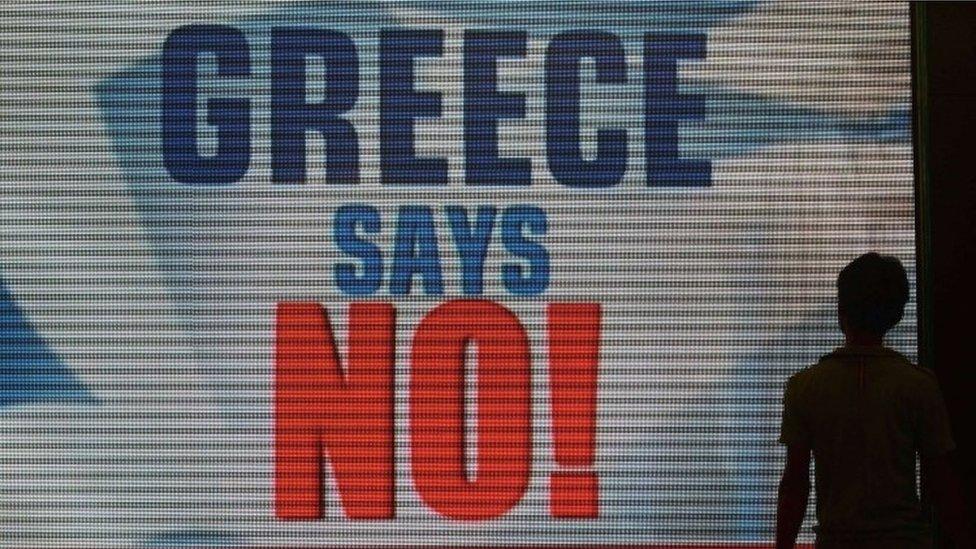

People's despair turned into riots on the streets, as they suffered spending cuts, high taxes and repeatedly slashed salaries and pensions.

More than 400,000 people emigrated and in 2013 the unemployment rate peaked at 27.5% - but for those under 25 it was 58%.

At the height of the crisis, some worried that the eurozone - the 19 countries that shared the euro - would collapse alongside Greece.

Are things better?

Three-quarters of Greeks think the bailouts harmed the country.

The economy is 25% smaller than when the crisis began and it will take decades to pay off its debt pile of 180% of GDP.

But for the first in almost a decade, Greece is off life support.

The economy has stabilised and grown slowly and it can borrow on international markets again.

Want to know more?

- Published20 August 2018

- Published20 August 2018

- Published19 August 2018

- Published19 August 2018

- Published22 June 2018

- Published10 January 2018

- Published24 July 2017

- Published15 June 2017

- Published18 May 2017

- Published16 July 2015

- Published10 July 2015

- Published28 November 2022

- Published10 July 2015

- Published13 October 2011

- Published5 May 2010