Tax row accountancy firm client wins HMRC court case

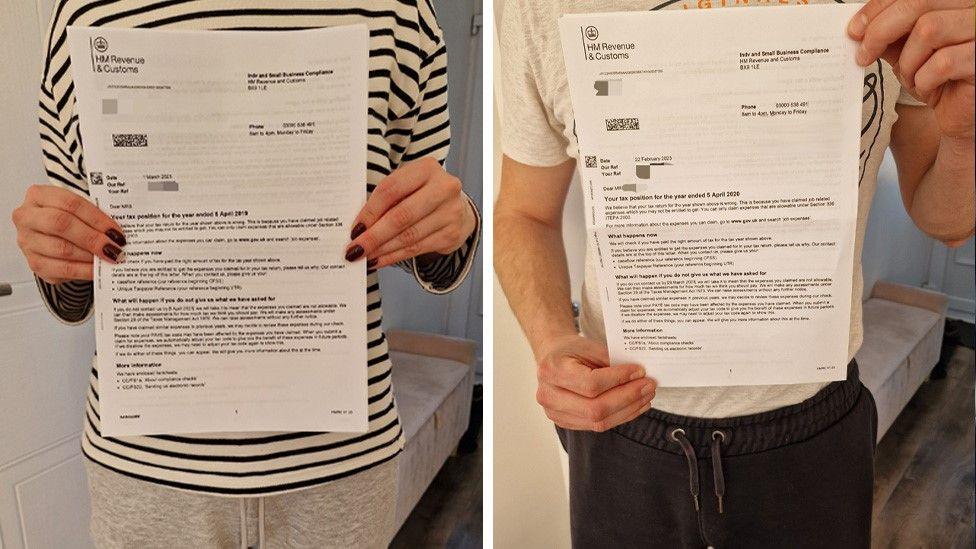

Hundreds of former Apostle Accounting clients, including couples, have received repayment demands from HMRC over their tax rebates

- Published

A man ordered to repay thousands of pounds after being caught up in a tax rebate scheme has won his case against HM Revenue and Customs (HMRC).

The taxman did not follow correct procedures when it tried to recover payments it had made to Julian Lowe, a judge has ruled.

Mr Lowe had used Suffolk company Apostle Accounting to claim money back on tax-deductible expenses, which HMRC subsequently said he was not entitled to.

HMRC said it was "reviewing the case to learn lessons for the future".

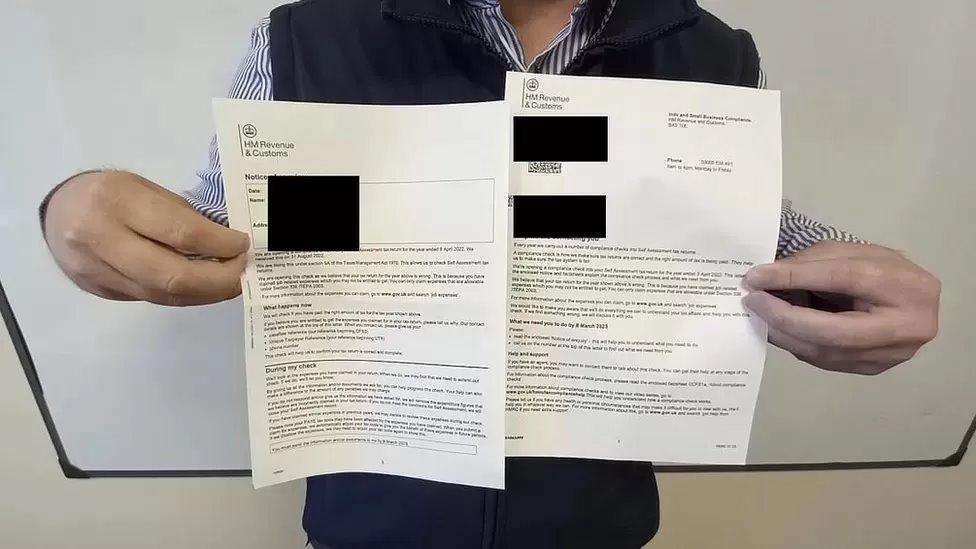

Hundreds of former Apostle clients have been sent letters by HMRC demanding repayment after they made similar claims.

Some of the demands run to tens of thousands of pounds, which prompted an outcry and interventions from MPs who took up their cases.

The Stowmarket-based firm, which is being wound up, is the subject of an ongoing police inquiry.

Mr Lowe and his legal representative did not respond when contacted.

In February 2023, HMRC wrote to the water industry worker to say it was opening an inquiry into his tax returns.

According to the judgement, external, HMRC took the view Apostle had made "carelessly inaccurate claims for deductible expenses, and no evidence of the business expenses had been provided to substantiate the claims".

Mr Lowe was then told he owed more than £12,000, but he appealed to the First-tier Tribunal (Tax Chamber),

His submission said there was "no evidence of carelessness on the part of either Apostle or the appellant".

Judge Nigel Popplewell said HMRC had based its assessments on the fact that no supporting documents had been provided to justify the expense claims.

But, he concluded, they had not made any attempt to obtain this evidence and allowed Mr Lowe's appeal.

The findings were issued earlier in September.

'No legal precedent'

Word spread across workplaces that Apostle was promising to help people claim tax relief for work expenses.

One former client who has been compiling a register of people affected has put the number at more than 800.

Apostle sent off their claims, and thousands of pounds in rebates were paid out.

HMRC then contacted these clients to say they were not entitled to the money and it wanted the cash back.

According to Joanne Walker, a technical officer for the Low Incomes Tax Reform Group, the decision will not automatically affect any other Apostle clients.

"It is important to remember that First-tier Tribunal cases are decided on their own merits and do not set a legal precedent," she said.

Ms Walker added: "For example, in a similar case, HMRC may have properly documented their evidence-gathering and decision-making process, and the assessments might be upheld."

HMRC does not comment on individual cases due to taxpayer confidentiality.

A spokesman said: "The tribunal's decision does not impact any other taxpayer as it relates only to the specific facts of this case."

The BBC has also approached a representative of Apostle Accounting for comment.

Get in touch

Do you have a story suggestion for Suffolk?

Follow Suffolk news on BBC Sounds, Facebook, external, Instagram, external and X, external.

- Published4 October 2023

- Published28 April 2023