HBOS report: 10 executives could face ban

- Published

Regulators should consider banning up to 10 former HBOS executives from working in the City, a report into the collapse of the bank has said.

That includes Andy Hornby, HBOS's former chief executive, and its former chairman, Lord Stevenson.

A separate report, from the Bank of England and the Financial Conduct Authority (FCA), blamed top executives for the bank's failure.

It was also highly critical of the former City regulator.

It said the Financial Services Authority (FSA) had been "deficient" in the way it handled HBOS.

Action 'as soon as possible'

The Bank of England/FCA report examined the failure of HBOS, while a barrister, Andrew Green QC, examined decisions taken by the FSA.

In his report, Mr Green suggests that the Bank of England's Prudential Regulation Authority (PRA) and the FCA should consider prohibition proceedings against former executives.

This decision should be taken "as early as possible next year", he said.

Andrew Bailey, the deputy governor of the Bank of England, promised rapid progress.

"It's not the intention to have a lengthy investigation. We will do this piece of work as soon as possible," he said.

He told the BBC's business editor Kamal Ahmed: "It's quite clear primary responsibility lies with the board and senior management of HBOS". He said it was right that Mr Green recommended "looking again at the question of the prohibition of people who haven't been prohibited".

Analysis: Kamal Ahmed, BBC business editor

In one sentence, the major regulator of a crisis-ridden banking system reveals the truth about the chaos in the run-up to the financial crisis.

"The FSA [Financial Services Authority] was stretched almost to breaking point."

It is a comment given to one of the report's authors, Andrew Green, by Sir Hector Sants, the chief executive of the FSA from 2007 until 2012.

Reading through both HBOS reports, time and again it is revealed that major questions about why a bank was engaged in reckless lending are missed.

Bans

Clive Adamson, former director of supervision at the FSA, told Mr Green that "the most culpable people were let off".

So far the only person to have been banned is Peter Cummings, who was previously the head of corporate lending at HBOS.

In 2012, he was fined £500,000, and banned from senior positions in banking.

No one else will face fines, as too much time has passed since the events took place.

Mr Green said the FSA was "misguided" when it took the decision not to take action against Andy Hornby, HBOS chief executive from 2006 to 2009.

Mr Hornby is currently the chief operating officer at betting firm Gala Coral. Following publication of the report, Gala Coral said Mr Hornby had been a key member of management for five years.

"During this time he has played a central role in the transformation of the business and has earned the continuing support of our colleagues, management and shareholders," it said.

Lord Stevenson is one former HBOS board member who regulators should consider banning, the report said

Other former HBOS executives in the frame include Lord Stevenson, who is a non-executive director at the bookshop Waterstones, and Mike Ellis, the former group finance director at HBOS and now chairman of the Skipton Building Society.

Lindsay Mackay, the head of HBOS's Treasury division from 2004, could also be banned. He is currently a director of Alpha Bank.

James Crosby, HBOS chief executive from 2001 to 2006, has retired. He gave up his knighthood in 2009, and surrendered part of his pension.

Eight former non-executive directors of HBOS - who were criticised in the report - said they disagreed with its findings.

The eight, including Lord Stevenson and Carphone Warehouse founder Sir Charles Dunstone, said the report had downplayed the "unforeseeable" effects of the financial crisis.

"The report does not contain evidence that would justify any further enforcement action against executives," they said in a joint statement.

'Deficient approach'

The Bank of England report says that when the then regulator, the FSA, investigated HBOS it relied too much on the bank's senior management.

It said the FSA's supervisory framework:

Had inadequate resources devoted to big banks

Was too trusting of senior management

Had a risk assessment process that was too reactive

Overall it said the FSA's approach was "deficient". The FSA was replaced by the FCA in April 2013.

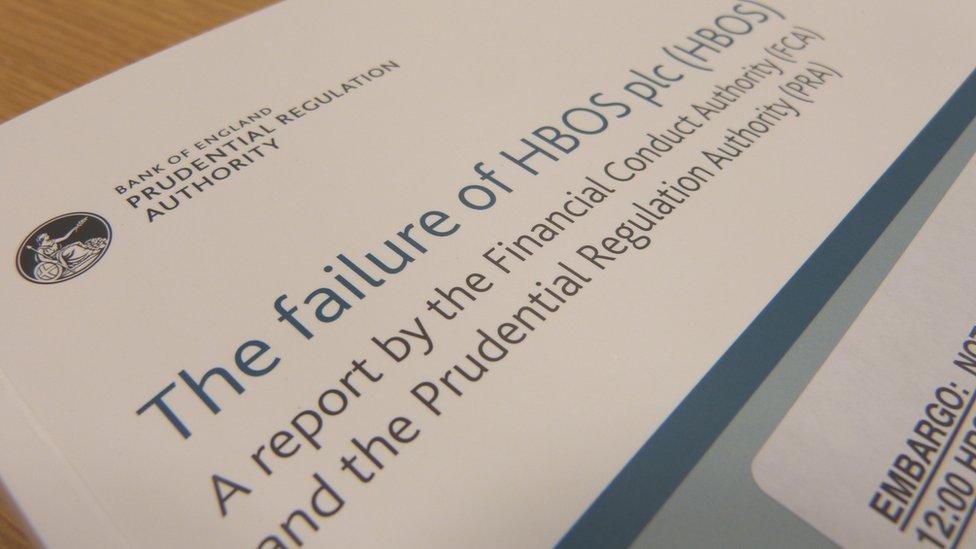

The main report runs to 400 pages, cost £7m, and took three years to write

'Risky'

The main part of the 400 page report - which took three years to compile - concludes that responsibility for the failure of HBOS "rests with the board and senior management".

The bank collapsed in 2008, and was subsequently taken over by the Lloyds Banking Group.

More than £20bn of taxpayers money was used to try to prop it up.

The report says that HBOS tried to increase its profits by moving towards "more risky propositions".

Among the reasons it failed were:

An excessive focus on market share, and short-term profitability

An over-exposure to property, at the height of the economic cycle

A culture which failed to balance risk and return

A failure by the board to challenge executive managers

The report says that HBOS's non-executive directors "lacked sufficient experience and knowledge of banking".

As a result, risk was not a priority for the board.

This was compounded, it said, by a lack of banking experience among top executives.

Both James Crosby and Andy Hornby "had limited banking experience".

- Published19 November 2015

- Published5 April 2013

- Published11 July 2014

- Published5 April 2013