UK house price growth shows signs of slowing, says Halifax

- Published

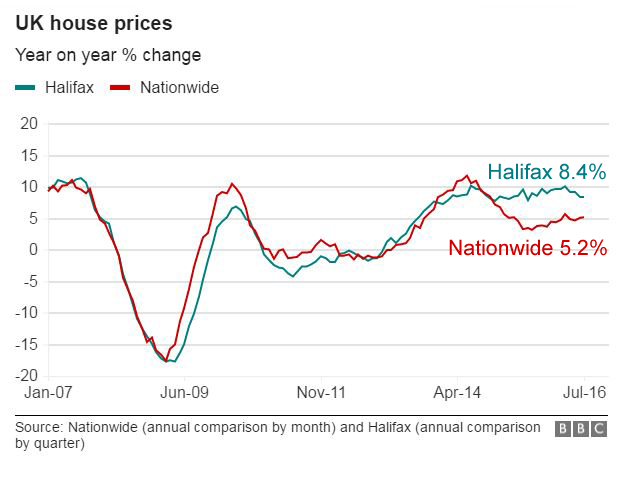

House prices in the UK fell by 1% in July compared with the previous month but were still 8.4% higher than a year ago, the Halifax has said.

The lender said that there were signs that house price growth was slowing.

However, it said that it was still too early to determine whether the UK's decision to leave the EU had already had an impact on the housing market.

On Thursday, the Bank of England cut interest rates and also suggested that house prices could fall.

The Bank reduced its base rate to an historic low of 0.25% from 0.5%, which will take an estimated £22 off the monthly mortgage bill of those with tracker deals.

Earlier in the week, a report from the Resolution Foundation analysed the fall in home ownership in major cities of the UK.

It said the proportion of home owners dropped from 72% in April 2003 to 58% this year in Greater Manchester, while there were also double-digit falls in West Yorkshire, the metropolitan area of the West Midlands and outer London.

House prices rose by 1.6% in the three months to the end of July, the Halifax said. The monthly rise in prices in June was offset by the fall in July, it added.

Russell Quirk, founder of estate agency eMoov, said: "Although it would seem the UK property market has lost steam since the vote with prices dropping 1% since last month, the summer period is always a traditionally slower time of year for residential property transactions."