Was Tulip Mania really the first great financial bubble?

- Published

One frosty winter morning, at the start of 1637, a sailor presented himself at the counting house of a wealthy Dutch merchant and was offered a hearty breakfast of fine red herring.

The sailor noticed an onion - or so he thought - lying on the counter. According to Charles Mackay, writing in Scotland 200 years later, he pinched it.

"He slyly seized an opportunity and slipped it into his pocket, as a relish for his herring, and proceeded to the quay to eat his breakfast. Hardly was his back turned when the merchant missed his valuable Semper Augustus, worth 3,000 florins, or about £280."

Relative to the wages of the time, that is well over $1m (£770,000) today.

Seeking a zesty accompaniment to his fish, the sailor had unwittingly pilfered not an onion, but a rare Semper Augustus tulip bulb.

And in early 1637, tulip bulbs were reaching some truly extraordinary prices.

Then, very suddenly, it was over.

In February that year, bulb wholesalers gathered in Haarlem, a day's walk west of Amsterdam, to find that nobody wished to buy. Within a few days, Dutch tulip prices had fallen tenfold.

Tulip Mania is often cited as the classic example of a financial bubble: when the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to be able to sell it again at a profit.

It may seem foolish to pay $1m for a tulip bulb - but if you hope to sell it on to another receptive buyer for $2m, it can still be a rational investment. This is known as the "greater fool" theory.

Whether or not it explains tulip mania however, is a subtle question.

50 Things That Made the Modern Economy highlights the inventions, ideas and innovations that helped create the economic world.

It is broadcast on the BBC World Service. You can find more information about the programme's sources and listen to all the episodes online or subscribe to the programme podcast.

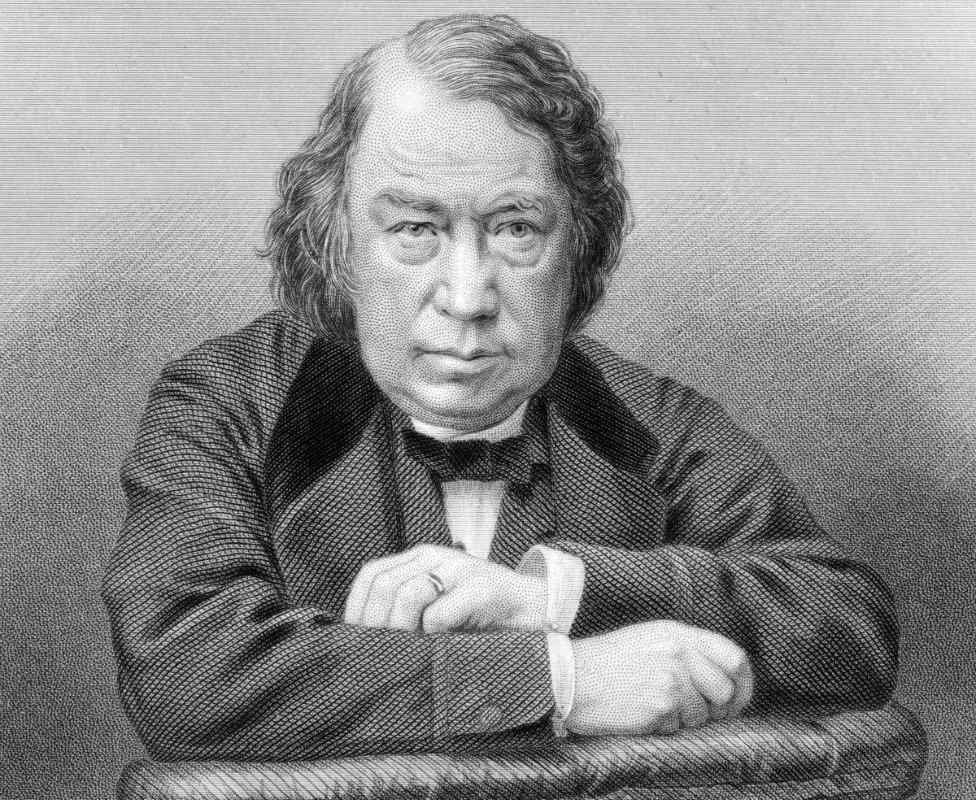

Charles Mackay's 1841 account has cast a long shadow over our imagination.

His book, Extraordinary Popular Delusions And The Madness of Crowds, is full of vivid stories about how the entire Dutch nation was involved.

But those extravagant tales - including the one I have just told you, about the hungry sailor - are probably false.

Is Charles Mackay to blame for the mythology surrounding Tulip Mania?

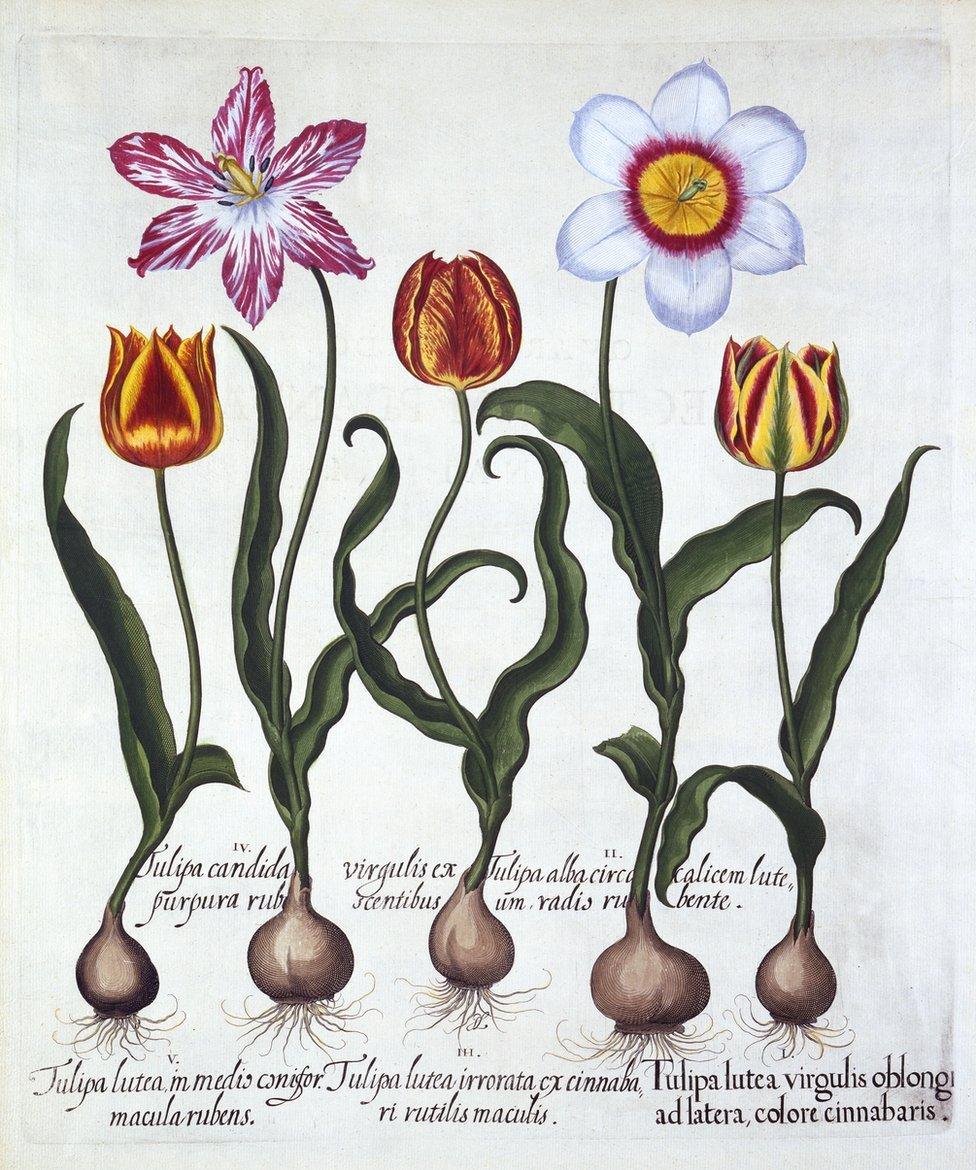

Tulips were part of a cornucopia of new plants to arrive in Europe in the 16th Century, including potatoes, green and red peppers, tomatoes, Jerusalem artichokes, French beans and runner beans.

At first, tulip bulbs were sufficiently unfamiliar to be mistaken for vegetables. On at least one occasion, someone roasted them with oil and vinegar - perhaps the kernel of truth in Charles Mackay's tall tale.

But once it became clear what to do with them, everyone began waxing lyrical about their beauty.

Some varieties, infected by a virus, changed from simple bold-coloured petals to exquisitely varied patterns.

Just as the super-rich today collect beautiful paintings at extraordinary prices, the newly wealthy Dutch merchant class began to collect and display rare tulips.

And not always honestly.

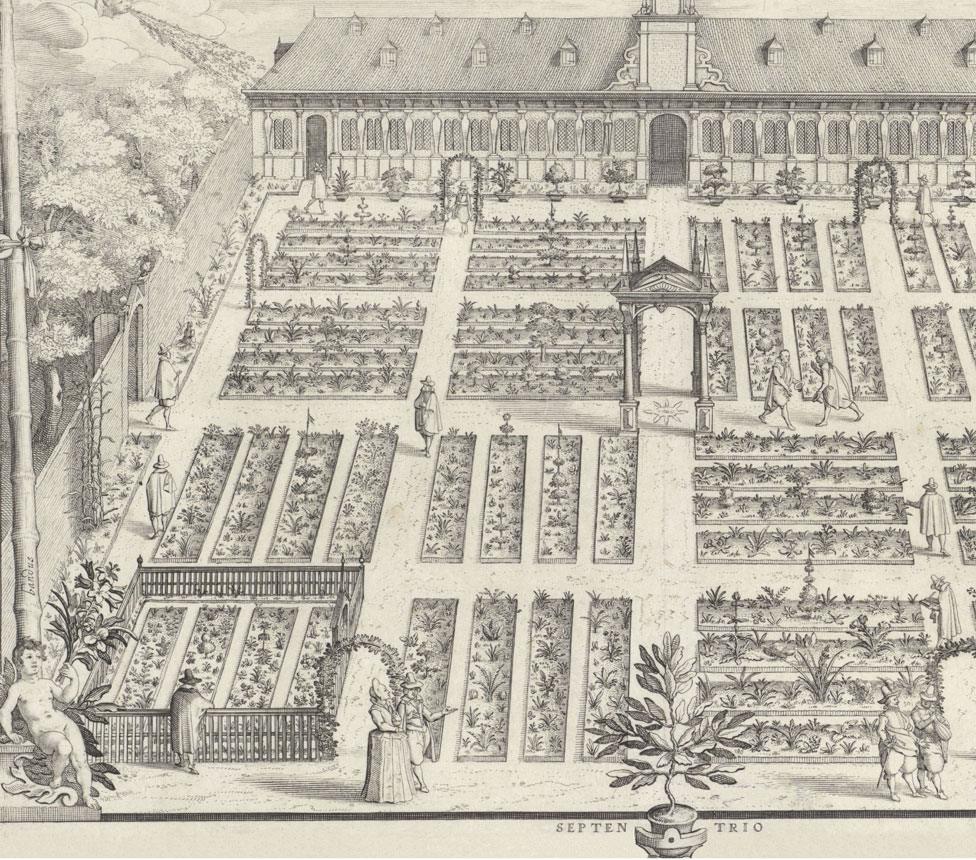

The celebrated botanist Carolus Clusius generously shared his tulips with friends and colleagues, yet suffered many thefts of rare plants. His treasures were, after all, just sitting in gardens.

Carolus Clusius was the first director of Leiden University's Hortus Botanicus, the oldest botanical garden in The Netherlands

On one occasion, Clusius had some unique flowers stolen, only to find them in the garden of a Viennese aristocrat. She denied all knowledge of their provenance.

As Mike Dash notes in Tulipomania, the philosopher Justus Lipsius wasn't impressed by the tulip collectors.

"What should I call this but a kind of merry madness?" he said, adding: "They do vaingloriously hunt after strange herbs and flowers, which having gotten, they preserve and cherish more carefully than any mother doth her childe."

But, in the early 1600s, the price of tulips just kept on rising.

As Anna Pavord writes in The Tulip, the flower was "the ultimate status symbol, the definitive emblem of how much you were worth."

Adriaen Pauw, who was fabulously wealthy and the closest thing Holland had to a prime minister at the time, built a garden full of artfully-positioned mirrors.

Adriaen Pauw's clever use of mirrors magnified his small tulip collection to great effect

In the centre were a few rare tulips, made by the mirrors to look like a multitude - an admission that not even Pauw could afford to fill his garden.

The highest price for which we have good evidence was 5,200 guilders for a single bulb, in that winter of 1637. That is more than three times what Rembrandt charged for painting The Night Watch just five years later, and 20 times the annual income of a skilled worker, such as a carpenter.

The idea that some poor fellow had his million-dollar tulip bulb consumed with a herring may be fanciful - the idea that the rarest bulbs were million-dollar treasures is plausible.

Could a tulip bulb really be worth a million dollars? It's not quite as absurd as it might seem.

Tulip bulbs produce not only tulips, but offshoot bulbs called offsets.

Owning a rare bulb was a bit like owning a champion racehorse, external: valuable in its own right, perhaps, but far more valuable because of its potential offspring.

Given how far the wealthy would go to possess unusual tulips, there was nothing foolish about bulb traders paying top guilder for the bulbs.

More things that made the modern economy:

Financial bubbles burst when expectations reach a tipping point: once enough people expect prices to fall, the supply of greater fools dries up. Does that explain the sudden collapse in prices in February 1637? Perhaps.

But there's another theory.

As rare bulbs such as Semper Augustus multiplied over the years, it is only natural that their price would fall, external.

In Haarlem - one of the warmer Dutch cities - February is exactly when tulip shoots would have burst through the soil. Having seen abundant shoots on their journeys, the bulb traders might have realised that the crop would be bountiful, and the rare flowers rather less rare than they had imagined, external.

If so, the fall in prices may have reflected an increase in supply, rather than the bursting of a bubble.

Whatever the reason, the mania subsided. The fallout was painful: many trades were not simple exchanges of cash for bulbs, but promises to pay for bulbs in future. Between buyers who didn't have money and sellers who didn't have bulbs, there was a good deal of grumbling over who owed what to whom.

But the prosperous Dutch economy sailed on regardless.

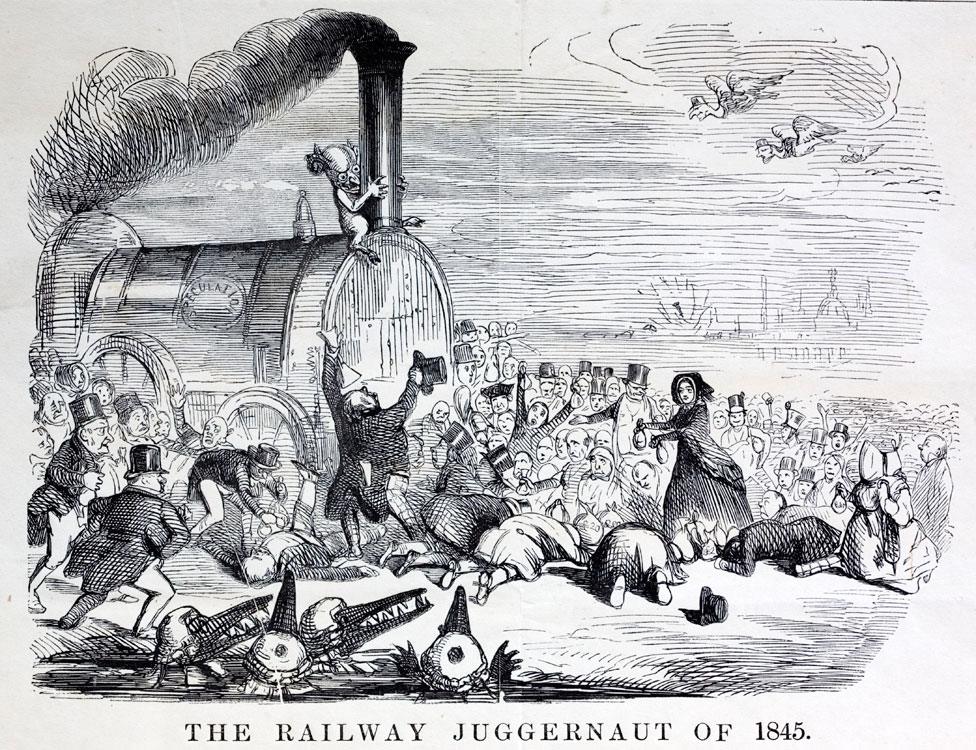

Later bubbles were much more consequential. Perhaps the greatest boom and crash in history was the railway mania of the 1840s, external.

A satirical cartoon about railway mania from 1845 shows a locomotive called "Speculation" ploughing through crowds of people, a devil clutching its chimney

Influential commentators waved away warnings of financial trouble ahead, and encouraged investors to bid up stocks in UK railway companies to ridiculous prices.

And right in the middle of it all was Charles Mackay himself, urging people to put their money into the railways and pooh-poohing those who were concerned that the whole affair would end in tears.

He had become famous by mocking the bubbles of the past - but had rather less to say about the far more serious bubble that he himself had helped to inflate.

Hindsight makes everything clear, but while you're caught in the middle of a bubble, the view is as confusing as Adriaen Pauw's garden of mirrors.

The author writes the Financial Times's Undercover Economist column. 50 Things That Made the Modern Economy is broadcast on the BBC World Service. You can find more information about the programme's sources and listen to all the episodes online or subscribe to the programme podcast.

- Published22 March 2019

- Published16 February 2019

- Published13 May 2018