Covid: 'I earned less, but spent the same'

- Published

Bron Davies says she needed to focus on money

Like many others working in the arts, Bron Davies lost her job as a theatre assistant producer owing to the economic effects of the pandemic.

The 25-year-old quickly found new employment, as a project manager for a food charity.

She also found her income had dropped by 20% - more than £5,000 a year in total. Yet, she admits, her spending did not reflect her lower take-home pay.

"Like a lot of people in the pandemic, I was earning less but was continuing to spend like I did before," she said.

"Quite quickly, I was spending more than I had coming in. I had savings, but I was eating into them. I realised there was no future in it."

Financial fitness

Finding herself on the cusp of serious financial problems, she volunteered to take part in a money coaching programme.

The Couch to Financial Fitness project is inspired by the popular Couch to 5K physical improvement programme.

It guides people through three simple activities a week over four weeks, to help them understand money basics, followed by a five-week extension to strengthen financial habits.

It is now available to everyone via the recently-launched MoneyHelper website, external - part of the government-backed Money and Pensions Service.

"Covid has been a health crisis, but it has also had a huge impact on people's finances," said the service's chief executive, Caroline Siarkiewicz.

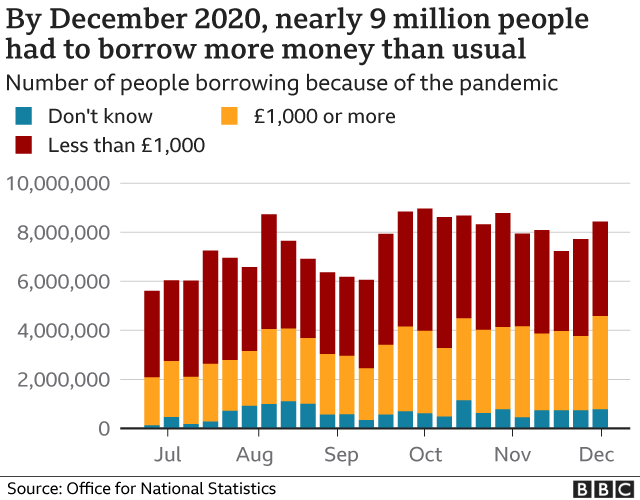

Its surveys have suggested that even before Covid, an estimated nine million people in the UK were struggling with debt and were often borrowing more to buy food or pay bills.

About 11.5 million people had less than £100 in savings, leaving them exposed to a financial shock from something as straightforward as their car breaking down.

The pandemic has created more money problems. Six in 10 of those asked said Covid had added to their financial concerns.

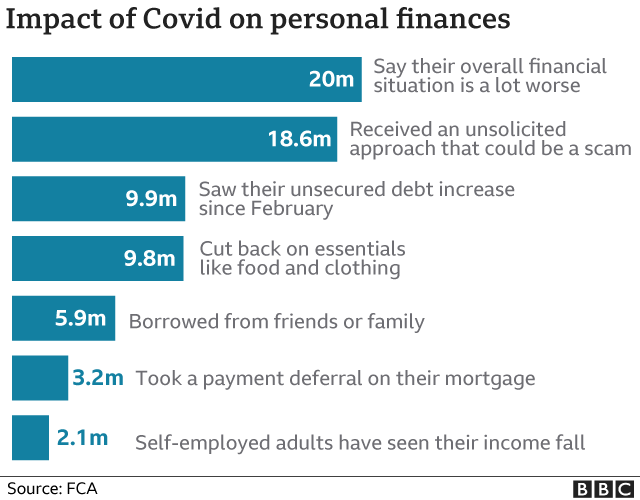

An estimated 20 million adults have seen their financial situation worsen significantly as a result of the pandemic, according to the Financial Conduct Authority, which regulates the banking sector.

Ms Siarkiewicz said the fact there were millions of people on the financial precipice, with many unable to discuss it with loved ones, meant a coaching system was key.

"We really want people to be confident to talk about money," she said.

Initially, the course addresses issues such as cutting costs, staying on top of bills and strengthening savings. It goes on to bigger financial lifestyle issues, including the financial considerations of starting a family, buying a home and funding retirement.

Bron Davies said she benefited from creating "a bit of headspace" to focus on money.

"It is not too daunting and has the right level of hand-holding," she said.

One of the best tips, she said, was to leave purchases in the basket for two or three days when online shopping.

"If you remember you still want it after a few days, then you can buy it. But I had often forgotten about it and did not really need it," she said.

She said everyone needed to be aware of their spending as Covid restrictions eased.

"It is simple to say that you deserve it when going out again, but if you had continued spending the same way in the pandemic anyway, it just does not balance out," she said.

Related topics

- Published22 March 2021

- Published11 January 2021

- Published16 June 2021

- Published21 January 2021