Goodnightpublished at 21:31 BST 4 August 2016

That is all from the Business Live page for today. We'll be back from 6am tomorrow. Have a good night.

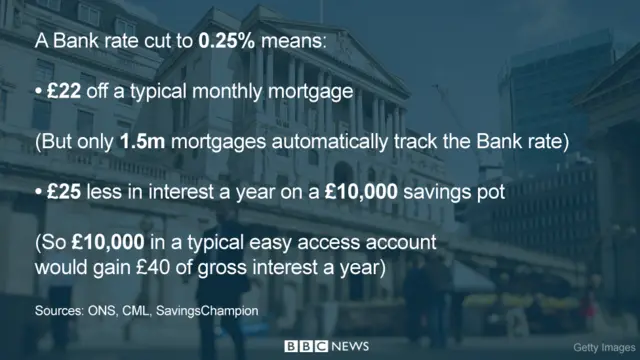

Bank of England cuts interest rates to 0.25%

FTSE closes up by 1.59% in London

Pound struggles, losing 1.4% against the dollar

Carney warns banks must pass on rate cut

Bank announces two new stimulus schemes

Bank expects no growth in second half of 2016

Bill Wilson

That is all from the Business Live page for today. We'll be back from 6am tomorrow. Have a good night.

Wall Street shares showed very little change at close on Thursday, ahead of Friday's US payrolls report.

The Dow Jones industrial average was down 3 points, the S&P 500 up half a point, and the Nasdaq Composite up 6.5 points.

In case you did not see it earlier, a visual guide

Image source, Kellogg's

Image source, Kellogg'sAmerican cereal maker Kellogg's has seen its quarterly sales fall by 6.6%. The company blamed the recent volatility in Venezuela.

Demand for its breakfast foods and snacks dropped in both the US and Asia, although Pringles sales continued to grow.

Michael Hewson, chief market analyst at CMC markets tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Quote Message"Today's decision to cut the base interest rate is both disappointing and ill-advised. The post-Brexit economic problems are down to consumer and business uncertainty and will not be solved by introducing monetary stimulus. By lowering interest rates, the Bank of England will distort the economy and potentially reduce growth.

Philip Booth, Research director, Institute of Economic Affairs

Quote Message"The Bank of England has done the right thing in cutting rates and starting a large quantitative easing programme. The short-term risks of Brexit must not be compounded by tight money, and with inflation rates already near zero there is little risk of excess inflation.

Sam Bowman, Executive director, Adam Smith Institute

Mark Urban, diplomatic editor at Newsnight, draws our attention to an exclusive by German newspaper Handelsblatt.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

FT reporter notes a potential lack of detail in today's stimulus plan.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The World at One

The World at One

BBC Radio 4

An interesting story from earlier in the day, looking at the thorny issue of why UK productivity is found wanting compared to other developed nations.

It seems issues of investment and skills are the key to improving UK productivity levels says the Federation of Small Businesses.National policy director Martin McTague spoke to James Robbins on the World at One soon after Theresa May hosted a meeting of small and medium sized companies in Downing Street at the same time that UK interest rates were being cut.

The Federation of Small Businesses on UK industrial strategy.

Nationwide Building Society tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Facebook

Image source, FacebookMore on the Facebook clickbait war.

The social network says it is updating its news feed algorithm to detect so-called "clickbait" headlines, by blacklisting the following:

In a blog, Facebook gives some examples of offences, external:

Zoe Thomas

US business reporter

Image source, Thinkstock

Image source, ThinkstockRatings agency Fitch called the Bank of England's decision to cut rates "a proactive policy response to the EU referendum".

But it warned that the move was just a "cushion" that would not fully offset the economic impact of the UK's decision to leave the European Union.

"The referendum will take a significant toll on the economy despite sterling's fall potentially supporting exports," the agency wrote in a report.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Our personal finance correspondent tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

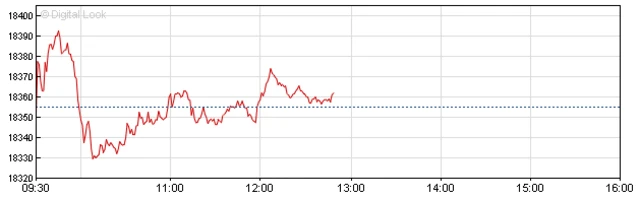

The UK interest rate cut has left Wall Street stocks decidedly unshaken.

US shares are barely changed in early afternoon trade in New York.

The Dow (see chart above) is up 3 points, the S&P 2 points, and Nasdaq 9 points.

Image source, AFP

Image source, AFPQuote MessageThe widely expected interest rate cut by the Bank of England is unlikely to stimulate a flurry of retail spending. The impact on consumer confidence or spending could even be detrimental in the short term. With the immediate impact of the interest rate cut being a drop in the value of the pound this move is hardly likely to boost flagging consumer confidence, which is a major factor in driving spend. In addition, consumers will see returns on savings fall yet further. In theory, this is supposed to stimulate spend by making it less desirable to save, but there seems little evidence this has worked up to now.

Nivindya Sharma, Senior Analyst at Verdict Retail

Referring to the rate cut, former business secretary Sir Vince Cable says: "Leaning too heavily on monetary policy is taking away from what the government should be doing in terms of the total budget, which is where the heavy lifting should be done."

BBC Reality Check tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Ford

Image source, FordFord has recalled 830,000 cars in North America due to potentially faulty door latches.

In certain situations, the company says "the door may unlatch while driving". It adds that it has identified "one reported accident and one reported injury" related to the issue.

The models in question are: