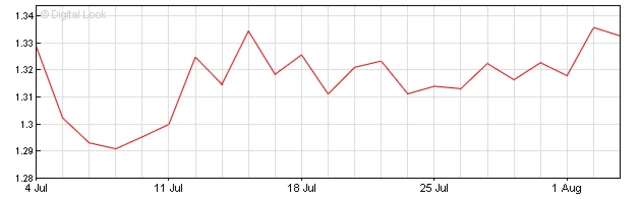

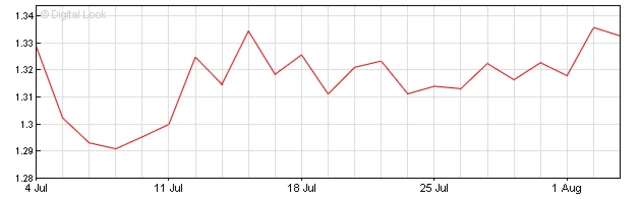

Pound still floundering against dollarpublished at 14:07 BST 4 August 2016

The pound is still floundering against the dollar, with sterling now down by 1.42% against the greenback at $1.3136, compared with $1.3333 at the previous close.

Bank of England cuts interest rates to 0.25%

FTSE closes up by 1.59% in London

Pound struggles, losing 1.4% against the dollar

Carney warns banks must pass on rate cut

Bank announces two new stimulus schemes

Bank expects no growth in second half of 2016

Bill Wilson

The pound is still floundering against the dollar, with sterling now down by 1.42% against the greenback at $1.3136, compared with $1.3333 at the previous close.

BBC personal finance reporter Kevin Peachey tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Matt Whittaker, chief economist at the Resolution Foundation says despite today's announcements, the responsibility for responding to the Brexit vote goes beyond the Bank of England, and into the political sphere.

Quote Message"The focus should therefore move away from Threadneedle Street and towards both Downing Street and the corridors of powers across Europe, as that’s where our economic prospects will ultimately be decided."

The World at One

The World at One

BBC Radio 4

Guy Anker, managing editor of moneysavingexpert.com, tells the World at One that savings rates are "dire and about to get more dire".

However, the rate cut is good news for those with tracker mortgages, as rates would go down, "saving around £20 a month".

He also advised people looking for a mortgage not to delay, as rates are unlikely to go much lower.

Money Saving Expert Guy Anker says saving rates are 'about to get more dire'

Mark Carney has just finished speaking. But business reporter Anthony Reuben doesn't want to leave the Bank:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Mortgage finance expert Alla Koblyakova, of Nottingham Trent University, has issued a warning in response to the Bank of England's rate cut.

Quote MessageProfit-driven lenders will be given the added incentive to provide larger loans to riskier consumers by this interest rate cut, and it was these types of loans which were the fundamental driver of the global financial crisis. The Government must consider this long-run effect and ensure that we do not return to a situation where we have a market which is saturated in low quality, high value and high-risk loans."

Mark Carney says he "fully recognises" that a long period of low interest rates puts personal savers in a "very difficult position" and that it has caused institutional savers to move to riskier assets in a bid to increase returns.

However, the Governor is adamant that the rate cut ultimately "lessens the challenge to the economy as a whole".

So what exactly is the Term Funding Scheme that the Bank has announced today?

Reuters tells us that the cut in Bank Rate will lower borrowing costs for households and businesses. However, as interest rates are close to zero, it is likely to be difficult for some lenders to reduce deposit rates much further, which in turn might limit their ability to cut their lending rates.

In a bid to mitigate this, the scheme will provide funding for banks at interest rates close to Bank Rate - which now stands at 0.25%. "This monetary policy action should help reinforce the transmission of the reduction in Bank Rate to the real economy to ensure that households and firms benefit from the MPC's actions."

Our business editor tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Look who's back! The former chancellor tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Rupert Harrison, George Osborne's former chief of staff who is now a Blackrock strategist, tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Some reaction to the rates decision:

Lucy O'Carroll, chief economist at Aberdeen Asset Management: "The Bank really needed to announce this kind of combination of measures. What will really count is whether the Chancellor provides a fiscal boost in the autumn. Monetary policy can't do much more on its own."

Daniel Mahoney, head of economic research at the Centre for Policy Studies: "The Bank's further loosening of monetary policy could prove problematic for the UK economy. The falling pound means that inflationary pressures are already building up, and today's decision will exacerbate them."

Business reporter Anthony Reuben tweets a comment from the Deputy Governor:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

FT economics correspondent Gemma Tetlow adds:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Former MPC member Andrew Sentance suggests the Bank of England's policy makers have over-stepped the mark

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

5 live presenter Colletta Smith tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

BBC's Kamal Ahmed asks what the Governor has to say to savers.

He responds: "This is something that we think about a lot. The returns for people who have set money aside are very low and will be for some time. We can't made the structural changes like government can. But we will ensure for savers, for pension funds and other pools of capital that there will be a better economic outcome, that the economy will grow more. That's our contribution."

More from Mark Carney's press conference:

"We have some limited flexibility to lower the bank rate further and that would also be passed through by banks. There are penalty rates if banks reduce lending."

Image source, Getty Images

Image source, Getty ImagesMark Carney issues a warning to banks that may not want to pass on the rate cut to those with variable rate mortgages, for example: "Let me say this about the banks: the banks have no excuse, with today's announcement, not to pass on this cut in Bank Rate and they should write to their customers and make that point."

Can we rule out negative interest rates, asks ITV's economics editor Noreena Hertz.

Mr Carney is robust in his response. "I'm not a fan of negative interest rates... We have other options to provide stimulus if more stimulus were needed."

The Governor adds that he wants rates to be at a "positive number, close to zero".