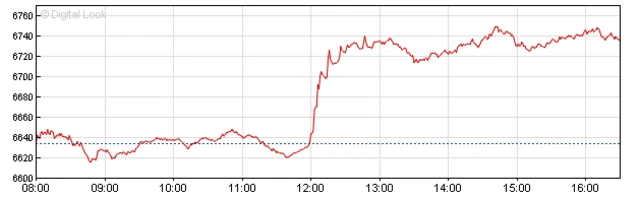

'Premature' rate cut?published at 17:11 BST 4 August 2016

Brexiteer and respected economist Andrew Lilico says the Bank of England's rate cut may turn out to be premature and unnecessary, external. He writes:

"The Bank thinks Brexit will mean 2.5% less GDP growth over the next three years, though probably no recession, and that what happens later depends crucially on our subsequent international trading relationships. I said in advance of the referendum a Brexit vote would probably mean 2-3% lower GDP growth in the period around exit, caught up later. So no surprise in the Bank’s numbers, there".