Unpicking Reeves' Spring Statement as Trump's tariffs threaten to bite the economypublished at 15:10 GMT 27 March

Gabriela Pomeroy

Gabriela Pomeroy

Live reporter

Image source, Reuters

Image source, ReutersToday we've been digesting all the news from Chancellor Rachel Reeves' Spring Statement. Growth forecasts are down, benefits are being cut and defence spending is going up.

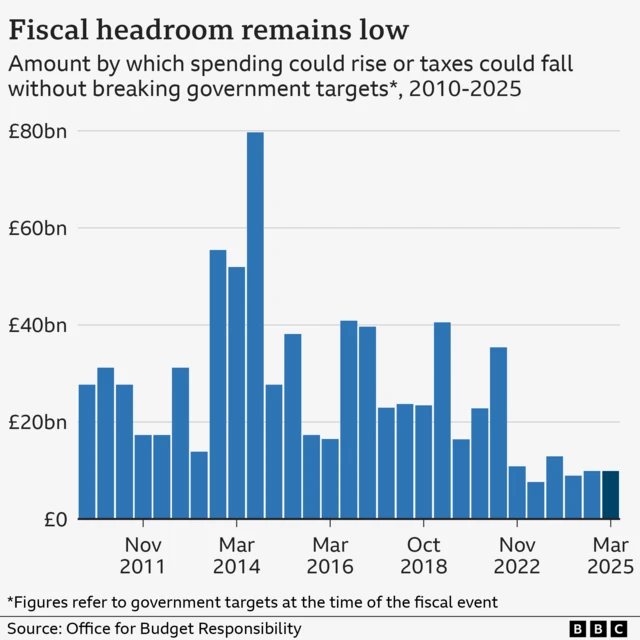

And on top of all that, US President Donald Trump wants to impose 25% tariffs on car imports and car parts. The government is in talks to fend off these tariffs, but the Office of Budget Responsibility (OBR) is warning that becoming embroiled in a trade war could undo the £9.9bn headroom Reeves has built into the economy.

The chancellor says that people will be better off under her economic plan, and argues that coming changes to Personal independence Payments (Pip) will help get people back to work.

Could taxes go up?

Some top economists think the government might have to raise taxes later in the year, if the economy and public finances get worse. The Institute for Fiscal Studies is warning that the chances of Reeves meeting her fiscal rules are "a coin toss" and says there's a "good chance" that the economic forecast will "deteriorate".

Benefits claimants worry for their future

We've been hearing from people who fear the coming cuts to welfare announced yesterday. One caller to the BBC's 5Live earlier today told us disabled people were being "scapegoated" by coming cuts to Pip.

We're pausing our live coverage for now - but you can read more about the Spring Statement.