What's expected to be in the Spring Statement?published at 08:36 GMT 26 March

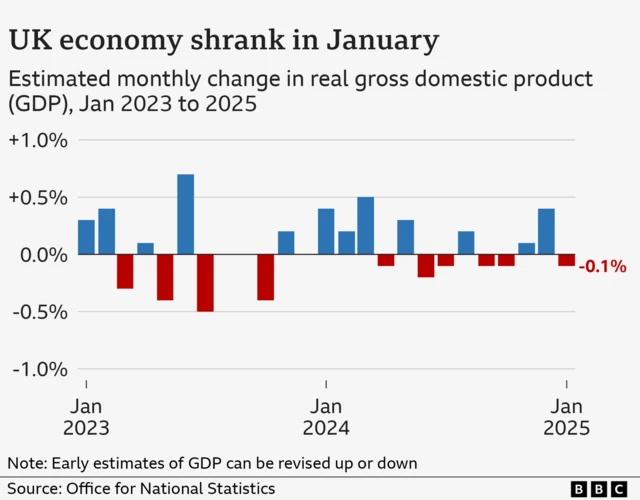

With the government under pressure over its finances, the chancellor is expected to update her growth forecast, and provide more detail on policies already announced.

Welfare spending

The government is looking to save £5bn a year on the welfare bill by 2030, and set out plans to that effect on 18 March. But last night it emerged Reeves is expected to widen those cuts after the Office for Budget Responsibility (OBR) estimated they would not save as much as intended.

The watchdog's assessment is that the changes will save £3.4bn in 2029/30 - meaning Reeves will save more than £1bn less than she thought.

The Department for Work and Pensions (DWP) will publish details today about who will be affected.

Civil service

The chancellor has pledged to reduce government running costs by 15% by the end of the decade.

About 10,000 civil service jobs are expected to go, including staff who work in HR, policy advice, communications and office management.

Aid and defence

The chancellor will argue the UK has to "move quickly in a changing world" and will confirm a £2.2bn increase in defence spending.

The government announced earlier this month that it would cut the foreign aid budget to increase military spending to 2.5% of national income by 2027.