Thanks for joining uspublished at 19:15 GMT 3 November 2022

We are about to bring our live coverage of the Bank of England's interest rate decision to a close.

Thanks for joining us.

Here's a round up of what happened today:

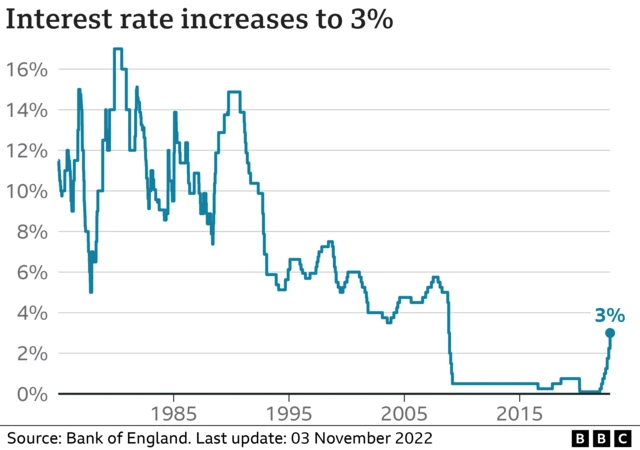

- The Bank of England announced it would increase interest rates by 0.75 percentage points to 3% - the biggest rise since 1989

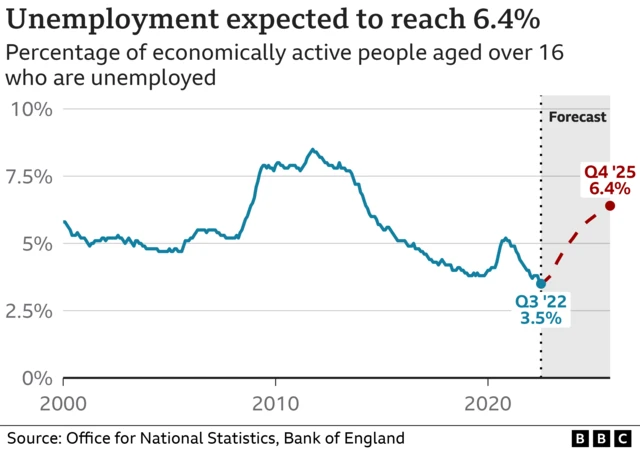

- The Bank also warned the UK is facing its longest recession since records began, saying the county would face a "very challenging" two-year slump with unemployment nearly doubling by 2025

- By raising rates, the Bank is trying to bring down soaring inflation as the cost of living rises at its fastest rate in 40 years

- But the rise means people coming off fixed-rate deals could see their interest payments increase by around £3,000 a year if they need to take out a loan that is 3.5 percentage points higher

- Chancellor Jeremy Hunt acknowledged the difficulties facing homeowners and businesses, but pledged to get the economy under control and "deliver lower mortgage rates, more jobs and long-term growth"

- Shadow chancellor Rachel Reeves said families could not withstand such high rate rises "when we've got rising food prices, rising energy bills and now higher mortgage rates as well"

This coverage was brought to you by Anna Boyd, Adam Durbin, Lora Jones, Thomas Mackintosh and Gem O'Reilly, and edited by Andrew Humphrey and Alex Kleiderman.