'No easy choices' for the Bank of Englandpublished at 12:30 GMT 3 November 2022

Experts have said that the Bank of England will be left with few "easy choices" as the UK economy deteriorates.

Yael Selfin, chief economist at KPMG UK said that a potential new spike in the soaring cost of living could come when the government support on energy bills offered under the Energy Price Guarantee comes to an end in April.

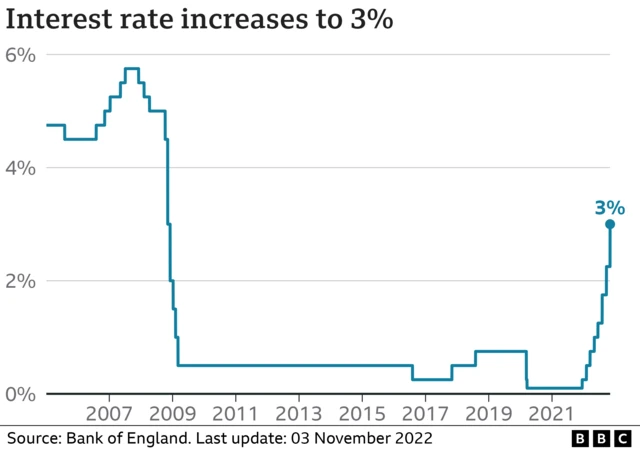

That could put pressure on the Monetary Policy Committee to raise rates even more quickly, she said.

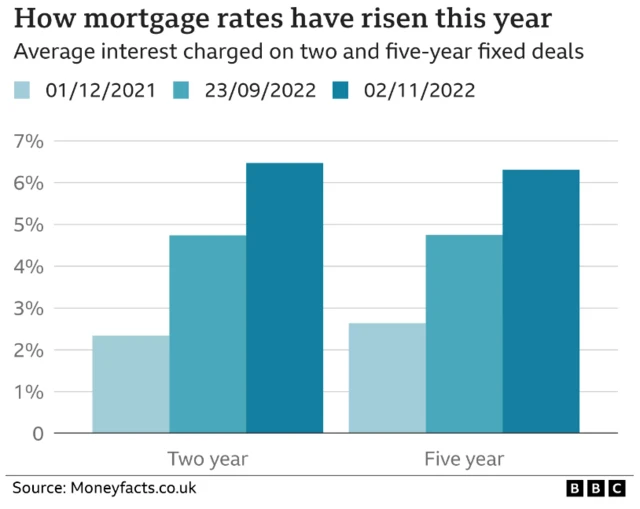

“At the same time, the outlook is riddled by the evolution of energy prices, while the risk of a significant fall in house prices looms in the background."

She said that the UK economy could shrink by more than 2% by the end of next year. Although it would ease pressures pushing prices up, it would see households and businesses face even more difficulties.