Shadow chancellor warns of hit to families and businessespublished at 10:35 GMT 3 November 2022

Image source, Getty Images

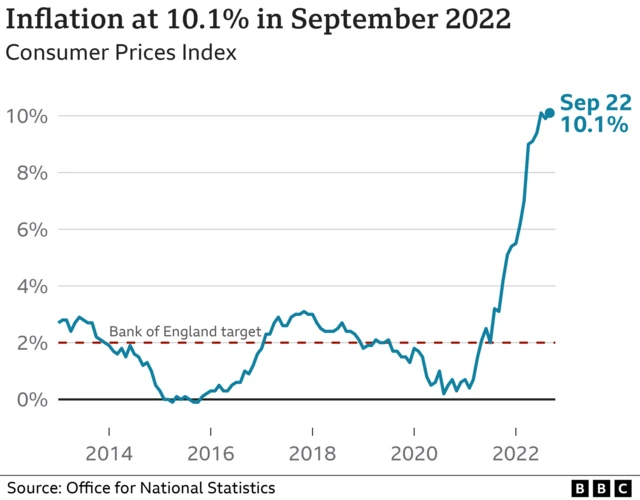

Image source, Getty ImagesSpeaking today at the Anthropy conference in Cornwall, Labour's shadow chancellor Rachel Reeves will warn that another interest rate rise at 12:00 would hurt businesses and households, and hit growth in the economy.

She is expected to say: "Rising interest rates will mean families with already stretched budgets will be hit by higher mortgage payments. It will mean higher financing costs for businesses."

She will warn that it could mean lots of business owners face tough decisions about whether to carry on in the face of rising costs.

Ms Reeves will also suggest that the UK in particular is exposed to economic shocks because of "weak growth, low productivity and underinvestment and widening inequality", calling for a need for a "new spirit of partnership" between the government and businesses going forward.