Sunak dealing with 'profound crisis'published at 07:29 GMT 3 November 2022

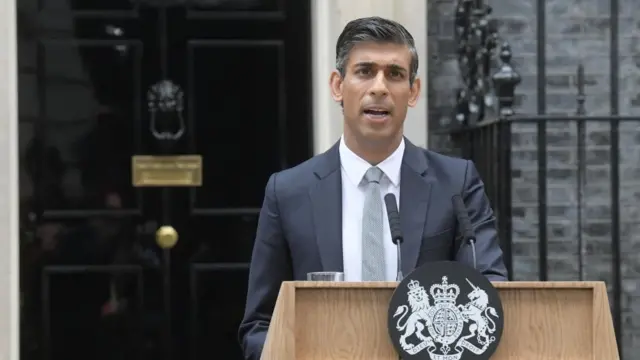

Rishi Sunak made it clear the economy is his focus after becoming the UK’s prime minister.

After entering Downing Street last week, he warned that the country faced a "profound economic crisis" - something he has looked to pin on the world’s slow recovery from Covid-19 and the Russian invasion of Ukraine.

While it’s true that global issues have had an effect - on food prices, for example - Sunak is also dealing with problems closer to home, after economic plans announced under his predecessor, Liz Truss, sparked turmoil.

A so-called mini-budget unleashed during Truss’s brief stint in Downing Street shook the confidence of investors in the UK economy and pushed up the cost of borrowing money - for the government and households alike.

Sunak and his chief finance minister, Chancellor Jeremy Hunt, are due to publish a renewed plan for repairing the public finances in an Autumn Statement on 17 November.

The pair met to discuss the plan earlier this week and a Treasury source said spending cuts alone would not be enough to ensure the government meets its targets on spending and debt.

Across-the-board tax hikes were "inevitable," the source said, adding: "It is going to be rough".

The department has not put a figure on what it calls the "fiscal black hole" facing the UK, but the BBC has previously been told it may be at least £50bn.