Deputy PM Raab declines to say sorry for surging inflationpublished at 12:27 GMT 16 November 2022

Image source, House of Commons

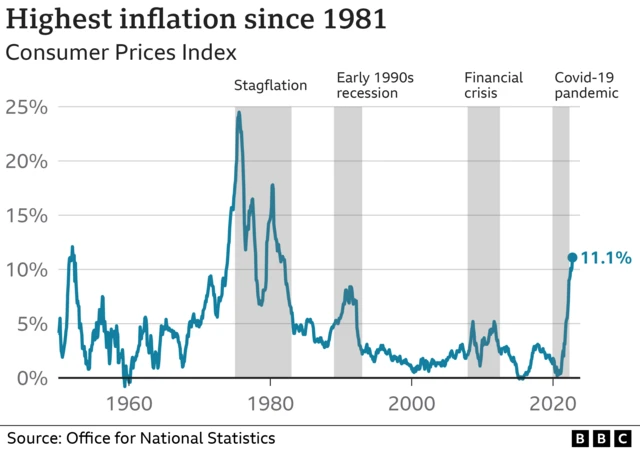

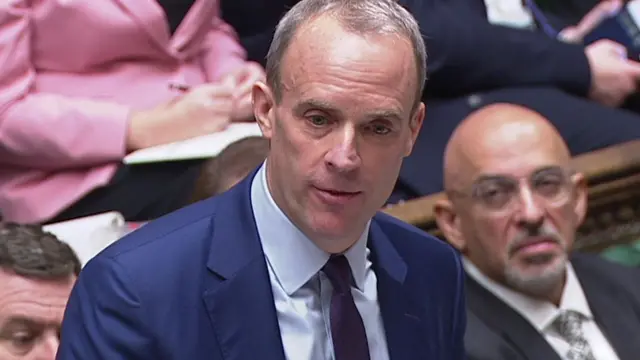

Image source, House of CommonsIn the House of Commons, Dominic Raab has been standing in for Rishi Sunak at PMQs, and is asked by the SNP's Kirsten Oswald if he will apologise for the mini-budget and the rate of inflation reaching 11.1%.

Raab acknowledged that inflation was "clearly a problem" but his government "has a plan to grip inflation, balance the books, to drive economic growth".

Oswald replied that if the government "won't even say sorry for the mess that they've made, what hope do we have of them fixing it?"