What can be done to tackle inflation?published at 05:56 GMT 16 November 2022

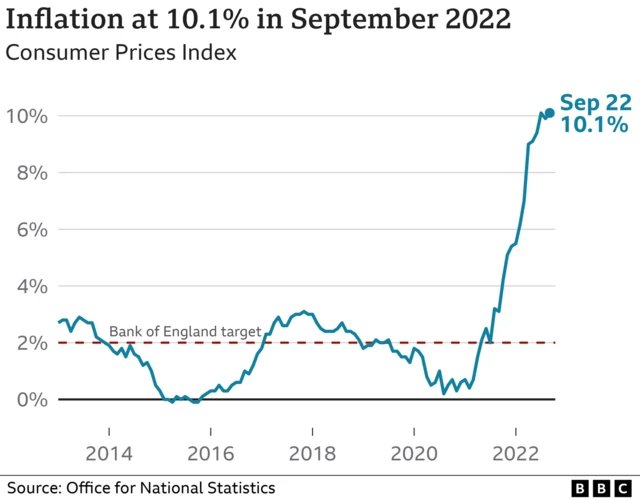

The Bank of England has a target to keep inflation at 2%, but current price increases are about five times that.

Its traditional response to rising inflation is to raise interest rates. This can encourage people to save, but means some people with mortgages see their monthly payments go up.

Raising interest rates also makes borrowing more expensive and - it is hoped - people have less money to spend. As a result, they will buy fewer things and prices will stop rising as fast.

In November, the Bank increased rates by 0.75 percentage point to 3%, the highest level since 2008, when the UK banking system faced collapse. Its next interest rate decision will be on 15 December.

But when inflation is caused by things like rising energy prices worldwide, there is a limit as to how effective UK interest rate rises can be in slowing inflation.