Scottish budget likely to target higher earners

- Published

Mr Swinney is standing in as finance secretary while Kate Forbes is on maternity leave

The Scottish government is expected to target the country's higher earners when it unveils its tax and spending plans for next year.

Finance Secretary John Swinney said his budget would include "decisive action" to tackle the cost of living crisis.

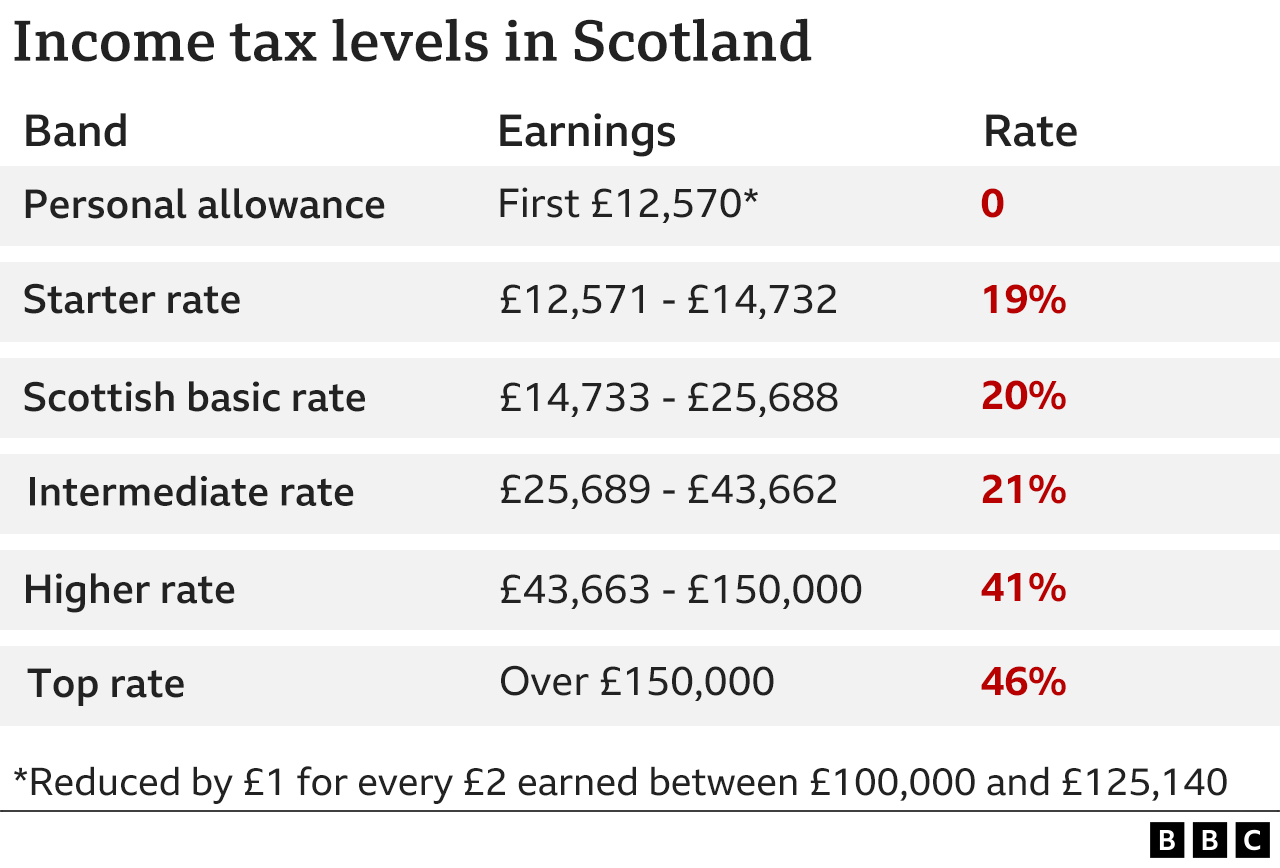

This is likely to include cutting the threshold at which people start paying the top 46p rate of income tax from its current level of £150,000.

There has been speculation that middle earners may also need to pay more.

Income tax rates in Scotland, as well as several other taxes, are set by the Scottish government rather than by UK Chancellor Jeremy Hunt.

BBC Scotland political editor Glenn Campbell said the government knows it will be criticised whatever it decides to do on taxation, with the SNP's manifesto at the last Holyrood election promising not to raise income tax rates or bands during this parliamentary term.

But he said he believed the government would take the view that the political and financial pain would be greater if it did not increase the amount of money it raises from taxation.

He added: "I would expect for a start that he will lower the threshold for the top rate of income tax in Scotland - as the UK government has already done.

"I wouldn't be surprised if he goes much further on tax. I think tax is the key to this budget."

Mr Hunt announced last month that the UK government would cut the threshold at which people start paying the top rate of tax in England, Wales and Northern Ireland to £125,000, and Mr Swinney is expected to at least match that.

There have been newspaper reports, external that the government is also considering raising the 41p and 46p tax rates.

The Scottish government has frozen the threshold for the 41p higher rate in recent years - it currently begins at £43,663 in Scotland, compared to £50,271 elsewhere in the UK - and could continue to do so.

However, it is much less likely to increase the rate that is paid by lower earners, which First Minister Nicola Sturgeon has previously said would be counterproductive in a cost of living crisis.

Mr Swinney may opt to change the thresholds where the different income tax rates kick in

Mr Swinney said the government would use its taxation powers to the "maximum extent that is responsible" and has warned that "difficult decisions" will need to be made on funding for public services.

Many departments are expected to be see real-terms cuts as the government continues to grapple with high inflation and interest rates and the cost of economic support measures.

The deputy first minister - who is standing in as finance secretary while Kate Forbes is on maternity leave - is expected to begin his budget speech at around 14:25.

He has said his plans would help create a "fairer, more equal Scotland" and will help address inequality, create wealth and opportunity and make sure public services remain sustainable.

However he has also warned that the country was still facing "sustained economic pressure" on public finances.

When rising prices, higher than expected pay deals and Ukrainian refugee support ate into the Scottish budget this year, ministers made cuts elsewhere to balance the books.

The difference now, as they look ahead to another tough year for the public finances, is that they can choose to use devolved tax powers to increase the cash they have to spend.

There is a clamour for them to do so from the trade union movement and others, while the Conservatives and key business voices are cautioning against putting up tax.

Ministers know they'll be criticised whatever they decide but from my conversations at Holyrood, I think the considered view is that the political and financial pain would be greater if they did not act.

While the SNP has a manifesto commitment to avoid increasing income tax rates during this parliament, they left themselves a bit of wriggle room in the small print.

In any event, they can still increase the tax paid by higher earners by freezing or lowering the thresholds at which the higher and top rates of tax take effect.

In the previous budget, Ms Forbes gave councils free reign to set local tax rates at whatever level they choose, and this is expected to continue next year.

The government has also faced calls from firms to freeze the poundage rate of business tax, with the Federation of Small Businesses in Scotland saying firms need to be given "room to breathe and space to grow".

Mr Swinney has said he will prioritise tackling child poverty in his spending plans, as well as moving to a "net zero" economy in terms of carbon emissions, and supporting public services in a sustainable way.

He has also promised to begin a "fundamental change in the way we manage public spending", in a bid to make public services and finances "more sustainable and resilient".

The Fraser of Allander Institute - an economic think tank based at the University of Strathclyde - has highlighted, external that extra funding from the UK Treasury should offset the impact of inflation over the next two financial years.

However much of that cash has already been ring-fenced for spending on health services, meaning other departments are still likely to face real-terms cuts.

The Scottish government is also committed to controversial plans for setting up a new National Care Service, which is estimated to cost between £664m to £1.26bn over the next five years.

And ministers will face questions about £20m which had been earmarked to deliver an independence referendum in the next financial year.

The Supreme Court has since ruled that MSPs cannot set up a vote without Westminster's backing, but the government insists it is committed to offering Scots a choice on their future.

Scottish Conservative finance spokeswoman Liz Smith told BBC Scotland that she expected too see tax rises given the "very difficult fiscal circumstances".

She added: "What I'm much more worried about is the differential between Scotland and the rest of the UK.

"It is absolutely essential that Scotland is an attractive place to work and live and invest, and if we see a widening of those differentials that affects that attractiveness."

Scottish Labour called on the government to use its tax powers, as well as cutting internal spending on advisors and spin doctors in order to funnel more cash to households.

Finance spokesman Daniel Johnson said: "The government will have to look at using its powers flexibly and to the maximum extent it can, and I can't say they always have in previous years."

The Liberal Democrats are calling for extra funding for insulation and energy efficiency, long Covid support and social care.

- Published14 December 2022

- Published15 December 2022

- Published15 December 2022

- Published14 December 2022