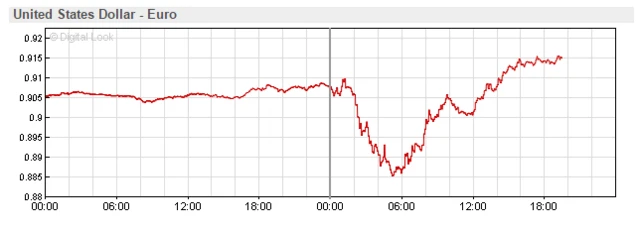

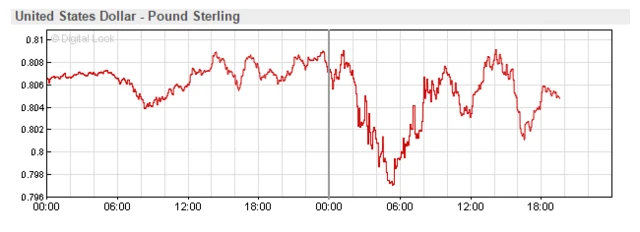

Until tomorrow...published at 21:36 GMT 9 November 2016

That's all from me folks, and thanks for reading Business Live on what has been a momentous day in US politics. We'll be back tomorrow with more news and views on the markets, along with further reaction to today's election result.