To recap...published at 15:49 GMT 9 November 2016

Image source, Reuters

Image source, ReutersIn case you missed it, Donald Trump has defied polls to seize the White House, steamrollering his Democrat rival Hillary Clinton.

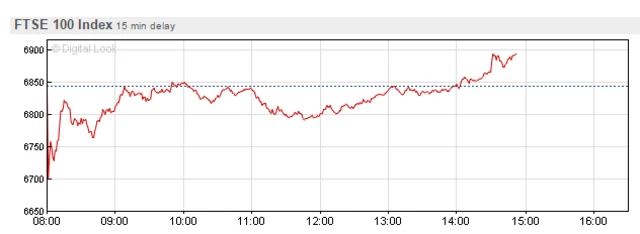

The impact on markets has been more muted than expected, with US indexes opening broadly flat and European stocks turning positive after a bumpy start.

Asian markets closed down, however, as fears over Mr Trump's anti-globalist foreign policy took hold.

We've been looking in more detail at what Mr Trump's victory could mean for business:

- John Mervin, the BBC's New York business editor, has been considering the key economic challenges that await Trump when he takes office in January.

- Kamal Ahmed, the BBC's economics editor, has been looking at the potential upsides for investors.

- Scotland business and economics editor Douglas Fraser has questioned whether Trump's economic policies - including a pledge to double US economic growth - are anything more than hot air.

- And we've been speculating about who might join Mr Trump's economic team.