FTSE sinkspublished at 08:01 GMT 9 November 2016Breaking

The FTSE 100 has plunged about 140 points, or 2%, as trading begins in London following the shock win for Donald Trump in the US presidential election.

US stocks trade higher after Trump win

Dollar climbs against the euro, falls against sterling

FTSE 100 closes higher

Get in touch: bizlivepage@bbc.co.uk

Daniel Thomas

The FTSE 100 has plunged about 140 points, or 2%, as trading begins in London following the shock win for Donald Trump in the US presidential election.

Economics editor Kamal Ahmed tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Donald Trump is speaking in New York after being declared president-elect of the United States.

He says he's just been called by Hillary Clinton to congratulate him on his victory.

"As with the Brexit vote earlier this year, we expect today to be a weak one for European insurers in general, having been risk on/risk-off trades over the past few weeks into the US election," KBW analysts say.

Top dollar-exposed insurance stocks Prudential Plc, Zurich, Aegon, Swiss Re are expected to be hit by the greenback's plunge.

Returns on German government bonds, seen as a safe haven during market turbulence and regarded as one of the world's safest assets, have fallen sharply as investors rushed in.

The yield - the return on investment to investors - on 10-year Bunds fell to 0.098% in early trading, compared to 0.188% at the close on Tuesday.

The return on US government bond fell 5 basis points to 1.81%.

Quote MessageA President Trump will be far more constrained in practice than he has sounded campaigning. Even though both houses are likely to controlled by Republicans, this is no guarantee of agreement on his more outlandish policies (building walls and initiating trade wars). He will be pushing on an open door repealing Obamacare and cutting taxes, which are arguably market-friendly, although both are likely harder in practice. The critical unknown is whether a Trump presidency pursues the policies of Trump the candidate, in particular his anti-trade, anti-China and anti-Mexico policies. Reason suggests that Congress and financial markets will regulate his ability to act. It is equally possible that these campaign rally cries are abandoned with the responsibility of power. But the real concern is that he will do what he says.

Eric Lonergan, Macro Fund Manager at M&G Investments

Hillary Clinton has called Donald Trump to concede the election, CNN reports.

Economics editor Kamal Ahmed tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Neil Wilson of ETX Capital says markets have just staged something of a rally as the Democrats vowed to continue the fight despite Donald Trump being on the cusp of victory.

"Dow futures, at one stage down 800 points, are now trading a little over 500 points lower for the day. Safe havens like the yen are now off their intra-day highs. At the moment – and it seems to be changing rapidly - markets are treading water waiting for confirmation.

"Nevertheless European stock markets are braced for a gigantic selloff this morning. The FTSE 100 is looking to open some 220 points lower amid a broad-based equity sell-off. A rising pound versus the weaker dollar will also weigh on the blue chips.

"Selling could accelerate very sharply if the vote does swing to Trump finally – in this situation the first to panics wins. If Clinton somehow pulls it out the bag there is a huge way up to travel. Either way volatility is the only certainty.”

The Associated Press has called the US presidential election for Donald Trump.

Today Programme

Today Programme

BBC Radio 4

Megan Greene, chief economist of Canadian firm Manulife Asset Management, tells Today that "a Trump victory was not at all priced into the markets".

That's leading to huge sell-offs in most areas, except for the yen and safe-haven assets like gold.

But there will be "a bit of a rebound, when people realise this doesn't actually represent Armageddon", she says.

Image source, Getty Images

Image source, Getty ImagesNobel Prize-winning economist Paul Krugman has turned to the question of when markets will recover if Trump does the presidency.

"A first-pass answer is never," he writes in the New York Times.

Putting Trump in charge of the world’s most important economy would be "very bad news":

"What makes it especially bad right now, however, is the fundamentally fragile state much of the world is still in, eight years after the great financial crisis."

The Fed already has very little wiggle room to help the US economy in a downturn, and is likely to get little support from a Trump White House, he said.

"So we are very probably looking at a global recession, with no end in sight. I suppose we could get lucky somehow. But on economics, as on everything else, a terrible thing has just happened."

HSBC's currency analysts say a victory for Donald Trump would see "further aggressive" selling of the Mexican peso and emerging market currencies.

The euro, Japanese yen, Swiss franc and gold would likely rally further, they say.

"The medium-term implications will hinge on the actual scale and nature of policy implementation. So far, no news agency has called the result officially."

Kamal Ahmed

Kamal Ahmed

Economics editor

Image source, Getty Images

Image source, Getty ImagesDonald Trump said it would be like Brexit plus plus plus. And for investors as they wake up to the news that Mr Trump is set for victory, the feeling will be very similar to that day in June.

The dollar is already weakening against "safe haven" currencies such as the Japanese yen.

Sterling is also strengthening against the dollar and gold - the ultimate safe haven dump - is up by nearly 4%.

US stock market futures - judgements on the direction of travel before the markets open in America later today - have already been suspended as selloffs overnight led to a 5% fall - the limit before automatic brakes are put in place.

In the UK, futures are down 3.5%. The FTSE is likely to have a torrid opening.

Image source, Reuters

Image source, ReutersHillary Clinton campaign chairman John Podesta has just said that the Democrat campaign will have nothing more to say tonight - it's just gone 2am in New York - about the state of the race.

Precious metal in biggest post-Brexit gains

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

BBC Mexico and central America correspondent Katy Watson tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Dominic O'Connell

Dominic O'Connell

Business Presenter, BBC Radio 4 Today programme

Image source, Getty Images

Image source, Getty ImagesIn the chaos caused by the likelihood of a Trump victory, institutional investors are focusing on one obvious question: is Janet Yellen, the chairman of the Federal Reserve, on the way out? Mr Trump has been extremely critical of her during the campaign, virtually accusing her of manipulating American interest rates to help his Democrat rival.

Mr Trump cannot remove Mrs Yellen, but she could resign were he to be confirmed as president. That would throw the path of Fed policy – the US central bank made a first tentative increase in interest rates last December, and there was a widespread expectation of another hike next month – wide open.

In the short term, an interest rate rise at the end of the year is now being discounted by City economists. In the longer term, Trump watchers think he is likely to appoint a much more hawkish Fed governor, meaning that US rates could eventually rise further and faster than most thought.

In the short term, the likely Trump win is good for the traditional safe haven investment. Gold is up $50 an ounce, and the Japanese yen is up more than 2% against the dollar. Japan’s central bank holds an emergency meeting later today; expect a statement that promises a willingness to intervene again to try and drive the currency down.

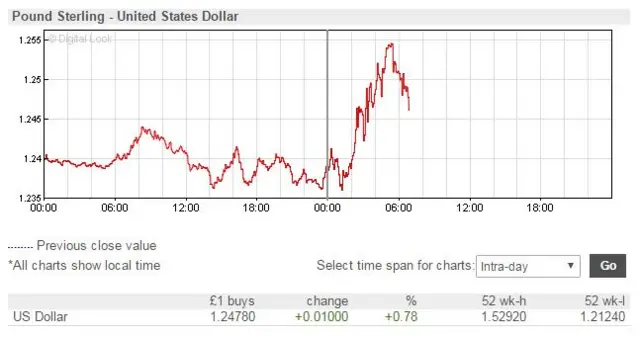

As the US presidential election enters the home straight, the pound's up against the dollar...

...but down against the euro.

Today Programme

Today Programme

BBC Radio 4

Image source, AFP

Image source, AFPLucy O'Carroll of Aberdeen Asset Management says one of the first things analysts will be doing if Donald Trump wins is scratch out their forecasts for a rise in US interest rates next month.

"That's now out of the question," she says.

There will also be doubt over Federal Reserve chair Janet Yellen keeping her job, given that the Republican candidate made negative comments about her during the campaign.