'Uncertainty' is backpublished at 06:55

Today Programme

Today Programme

BBC Radio 4

When stock markets tumbled following the Brexit vote, the word "uncertainty" was used a lot.

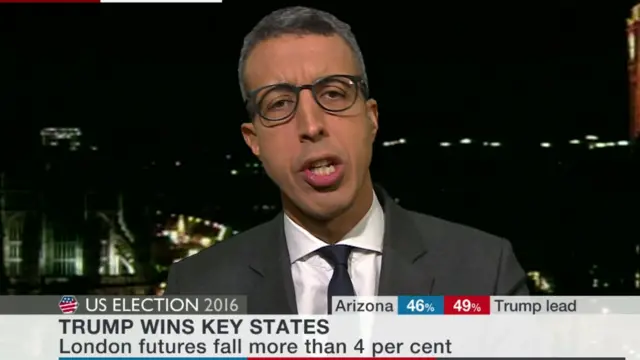

Laura Lambie, senior investment director at Investec, says uncertainty is now back again because markets do not know what a Donald Trump presidency would look like.

"He's been very light in detail on what his plans are for the domestic economy," she tells Today.