'Sea of red' on Asian marketspublished at 09:45 GMT 9 November 2016

BBC News Channel

BBC News Channel

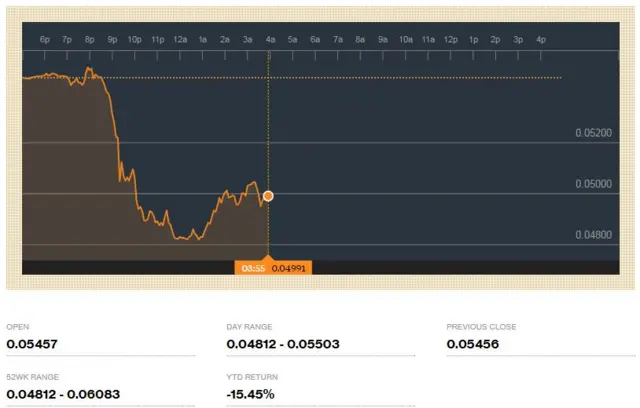

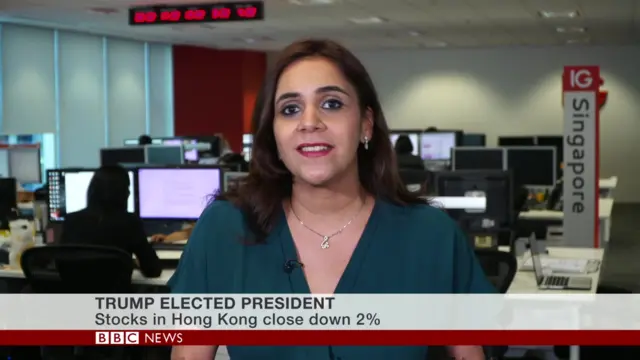

All of the major markets in Asia posted heavy falls earlier today, looking like a "sea of red" at one point, says BBC Asia business correspondent Karishma Vaswani.

While most are now closed, markets in India are still trading and are down about 1.2%.

European markets have regained some of their earlier losses, however.

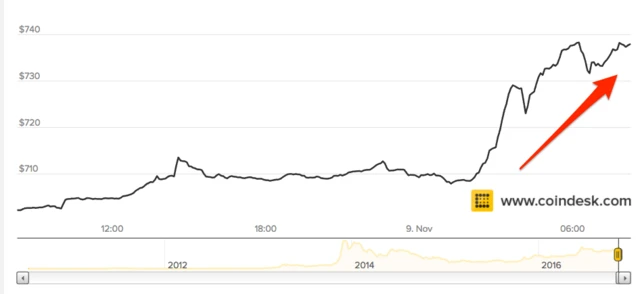

The safe-haven Japanese yen has been rising against the US dollar, while the peso has fallen sharply.